Abstract

This study examines whether the Bitcoin market satisfies the (weak-form) efficient market hypothesis using a quantum harmonic oscillator, which provides the state-specific probability density functions that capture the superimposed Gaussian and non-Gaussian states of the log return distribution. Contrasting the mixed evidence from a variance ratio test, the high probability allocated to the ground state suggests a near-efficient Bitcoin market. Findings imply that as Bitcoin evolves into an efficient market, speculators might encounter difficulty in exploiting profitable trading strategies. Furthermore, when policymakers initiate tight regulations to control the market, they should closely monitor market efficiency as an index of price distortion.

Similar content being viewed by others

Introduction

“The rapidly evolving world of digital money”

New York Times, March 18, 2015.

The rapidly growing market capitalization and extreme price fluctuations of the cryptocurrency market have prompted policymakers and economists to define cryptocurrency within a financial and economic context. Many studies use Bitcoin, which has the longest history and the largest market capitalization, as a benchmark for cryptocurrency research. Considering the potential impact of transitioning to a paperless digital society on the financial market and real economy, it is important to analyze the Bitcoin market with quantitative evidence.

One of the hottest debates in finance and economics is whether the market is efficient. Over time, numerous studies have investigated the market efficiency of various assets for asset pricing, risk management, and asset allocation. Since Fama1, this landmark issue has been dealt with based on the concept of market information and return predictability. According to the efficient market hypothesis (EMH), since investors’ rational expectations based on relevant information are quickly reflected in market prices, price fluctuations are unpredictable. This has been tested in stock, bond, foreign exchange, and other emerging markets. The market information is divided into three levels: (1) historical price and return, (2) all publicly available information (in the public domain), and (3) information privately known or known only to a limited group of market participants. The weak-form EMH states that price is unpredictable using the first level of information.

We extend the literature by examining the weak-form EMH of Bitcoin. Some recent studies reported that the Bitcoin market does not follow EMH2,3,4,5,6,7,8,9,10. However, other studies documented that the Bitcoin market follows EMH11,12,13,14. For example, in opposition to Urquhart10’s findings, Nadarajah and Chu15 found that a power transformation of Bitcoin returns is weakly efficient. Moreover, several studies have reported that the Bitcoin market is still transitional as it is currently inefficient; but steadily improving16,17,18,19,20,21. For instance, Sigaki et al.22 provided evidence of the changes in informational efficiency of the cryptocurrency market, which could have originated from collective phenomena in marketplaces23. Essentially, there is still mixed evidence on the efficiency of the Bitcoin market.

Among the various methods for measuring market efficiency, the variance ratio (VR) test is a well-known standard based on the random walk hypothesis24; the increments of log price series are Gaussian white noise25. We first examine whether the VR test is suitable for testing the EMH for the Bitcoin market. Then, we propose an alternative analytical framework based on quantum mechanics, i.e., the quantum harmonic oscillator (QHO). This modeling framework considers the market forces affecting price changes from short-term fluctuations to long-term equilibrium26. In particular, the solution of the QHO model is a superposition of infinite eigenstates, which form an orthogonal basis encompassing all distribution functions. As a result, our model nests the random walk as a ground-state solution. Accordingly, we analyze the market efficiency of Bitcoin by estimating the probability allocated to the ground state of the QHO model, i.e., the Gaussian distribution.

When share prices fully reflect the information contained in historical prices, consistent alpha generation is impossible. So, does the Bitcoin market work efficiently? Put differently, does the log of Bitcoin prices follow a random walk? This study provides novel evidence to the extant debate on the efficiency of the Bitcoin market: (1) “What are the limitations of the VR test to examine the EMH?”; (2) “Can QHO overcome the limitations of the VR test?”; and (3) “How to economically interpret market efficiency evaluated through quantum mechanics?” In a nutshell, we provide evidence supporting the efficient market characteristics of Bitcoin using annual fluctuations of the ground state probability, considering the Bitcoin price regimes. We also explain the rationale behind our findings using market measures such as the liquidity index. Finally, we provide implications for both investors and policymakers regarding the difficulty in exploiting profitable trading strategies and an index of the price distortion, respectively.

This paper is organized as follows: Section "Data and methodology" describes the data and methodology, Section "Results and discussion" discusses the results, and Section "Conclusions" concludes the paper.

Data and methodology

Data

The daily price of Bitcoin is collected from Quandl.com. The data of the other assets, for comparison purposes, are taken from the World Gold Council (gold) and Federal Reserve Bank of St. Louis (USD/EUR exchange rate and S&P 500 index). The period of data collection was from September 01, 2010, to March 31, 2019 (3,134 days). To match the trading dates of Bitcoin and the other assets, we obtained a total of 2,134 observations of daily data (While the Bitcoin market is constantly open (24 hours every day), data for the other comparative assets were available only on trading days.). Then, we took the first difference in log prices and annualized the return as

where \({x}_{t}\) and \({p}_{t}\) are the annualized log return and price at day \(t\), respectively.

Table 1 shows that the mean and standard deviation of Bitcoin’s log returns are quite large, compared to the other assets. The Bitcoin returns show positive skewness, implying investors’ risk-loving attitudes. Moreover, the distribution is extremely highly leptokurtic given that excess kurtosis is over 40, indicating that the data do not follow a normal distribution27,28,29,30.

VR test

The VR test examines whether the log price series follows a random walk24,31,32. The key idea is that the variance of the increments in a random walk grows proportionally with the sampling interval \(q\). If a time series follows a random walk process, the variance of its \(q\) th difference should be \(q\) times the variance of its first difference. Accordingly, the variance ratio \(VR(q)\) is

with

where \(Y_{t}\), \(\mu\), and \(\varepsilon_{t}\) are the log price, drift parameter, and error term. \({\widehat{\sigma }}^{2}\) is the maximum likelihood estimator of variance.

Under the homoscedasticity assumption, the null hypothesis of the VR test is that the log price series follows a random walk: equivalently, \(VR\left(q\right)=1\). If the variance ratio is too high \(VR\left(q\right)>1\) or too low \(VR\left(q\right)<1\), then the log return has either positive or negative autocorrelation.

QHO

A stochastic differential equation is widely used to describe various random behaviors in the financial market such as mean reversion33, stochastic volatility34, jump process35,36,37,38, controlled growth process39, and process evolving according to a size-independent proportional growth rate after an exponentially distributed period40. Here, we specifically implemented the method introduced by Ahn et al.26 and modeled the evolution of the log return distribution. We started with the following stochastic differential equation:

where \(x\) represents an asset return, \(\mu (x,t)\) denotes a drift, \(\sigma (x,t)\) represents volatility, and \({W}_{t}\) is a standard Wiener process.

The Fokker–Planck (FP) equation is obtained from Eq. (1) by introducing the probability density function (PDF) \(\rho (x,t)\) of the random variable \(x\) at time \(t\):

where \(D\left(x,t\right)\equiv {\sigma }^{2}(x,t)/2\) is the diffusion coefficient and \(V(x,t)\) is the external potential determining the drift term according to \(\mu \left(x,t\right)\equiv \partial V(x,t)/\partial x\). For constant \(D\) and time-independent potential \(V(x)\), Eq. (2) can be expressed as the FP operator:

where \(\widehat{L}={V}_{xx}+{V}_{x}\partial /\partial x+D{\partial }^{2}/\partial {x}^{2}\).

To solve Eq. (3), we examine the steady-state solution \({\rho }_{s}\left(x\right)\) satisfying \(\widehat{L}{\rho }_{s}\left(x\right)=0\)41,42 and introduce the wave function \(\Psi \left(x, t\right)\) with Hermitian operator \(\widehat{H}\) as

Then the FP operator in Eq. (3) leads to

which yields \(\widehat{H}=-{V}_{xx}/2+{V}_{x}^{2}/4D-D{\partial }^{2}/\partial {x}^{2}\) and Eq. (3) can be rearranged into the Schrödinger equation with imaginary time \(\tau \equiv -i\hslash t\) and mass \(m\equiv {\hslash }^{2}/2D\)

where the effective potential \(U\left(x\right)\) is given by26

with \(k\equiv {d}^{2}U/d{x}^{2}{|}_{0}\). Near equilibrium, \(U\left(x\right),\) is approximated by a harmonic potential and the system reduces to a harmonic oscillator.

Accordingly, the general solution of Eq. (4) bears that of the FP equation and, in particular, the \(n\)th eigenfunction of the harmonic oscillator is

with the corresponding eigenenergy \({E}_{n}=n\mathrm{\hslash }\omega\), and \({H}_{n}\) is the \(n\) th Hermite polynomial43.

Finally, we obtain the general solution of the FP equation whose time-independent solution is a mixed \(\chi\) distribution by transforming the solution of the Schrödinger equation into that of the FP equation, which leads to the PDF in the following form

where \({A}_{n}\) is an amplitude parameter determined by the initial distribution, which remains to be estimated. The random variable \(x\) follows the Gaussian, Rayleigh, and Maxwell–Boltzmann distribution, etc. for \(n=0, 1, 2, \cdots\). They all describe the displacement of a particle, that is, the first difference in log prices, in \((n+1)\) dimensional Euclidean space spanning Hilbert space.

Results and discussion

VR Test

Table 2 shows the VR test results for the daily log Bitcoin price series. The random walk hypothesis is partially rejected under the homoscedasticity assumption. Specifically, there is mixed evidence: the log of Bitcoin’s price series follows the EMH in the long-run (\(\mathrm{VR}(q)\approx 1\)) in line with previous literature12,44,45, while it appears to have a mean-reverting property (\(\mathrm{VR}\left(q\right)<1\)) in the short-run which is consistent with Corbet and Katsiampa46.

To ensure the adequacy of the VR test, it must hold that the innovations of log price series, that is, the log return series, are Gaussian white noise. However, several previous studies have shown that power law emerges in the tail distribution of Bitcoin’s return series47,48,49,50. Accordingly, we conduct normality tests on the residuals of random walk specification. Table 3 indicates that the null hypothesis, the innovations of the log price series are normally distributed, is rejected at the 1% significance level for the two test statistics such as Jarque–Bera and Shapiro–Wilk tests regardless of sampling intervals. This indicates that the VR test is limited, requiring another approach.

QHO

Before testing the market efficiency through the QHO, we investigate whether the QHO clearly explains the log return distribution of Bitcoin. Here, we divide the overall sample period into two sub-periods, i.e., low and high price regimes, as the dynamics of Bitcoin price appear differently due to the significant difference in its price level51. The low price regime extends from September 1, 2010, to February 26, 2013, and the high price regime spans from February 27, 2013, to March 31, 2019. Figures 1 (a) and (c) show the histograms of log returns in the Bitcoin market and the PDFs estimated from (i) the QHO and (ii) the random walk model (RWM) in the two regimes. Figures 1 (b) and (d) display the quantile–quantile (Q–Q) plots for the residuals of each model. The PDFs estimated by the QHO fit well, while those by the RWM significantly underestimate the data at the zone near zero, regardless of the price regimes. This is confirmed through two goodness of fit tests, i.e., Kolmogorov–Smirnov and Cramer-von Mises tests (Table 4). Moreover, the likelihood-ratio (LR) test compares the goodness of fit of two competing models based on the ratio of their likelihoods and further elaborates that the QHO describes the data better (Table 5).

Model estimation results. Panels (a) and (c) plot the PDFs of each estimated model in the low and high price regimes, respectively. Panels (b) and (d) describe Q–Q plots for the residuals of each model by standardized normal order, plotted with a regression line, in both regimes. Both models are estimated using a daily sampling interval (q = 1). Outliers that deviate from the mean by more than \(2.58\times \mathrm{Std}.\mathrm{ Err}.\) are excluded.

In Table 6, the mean squared error (MSE) and mean absolute error (MAE) show that the PDFs derived from the QHO (mixture \(\chi\) distribution) have smaller errors than those from the RWM (Gaussian distribution) in both price regimes. This is because the solution of the QHO is a generalized solution of the RWM, capturing both Gaussian and non-Gaussian features together. Particularly, the QHO includes market uncertainty through the properties of superimposed wave functions and assumes that the resilience of the harmonic oscillator reflects the restoring force that drives market return to the long-run equilibrium26: market friction is reflected in the stochastic differential equation.

Table 7 summarizes the estimated probabilities assigned to the first three low-lying eigenstates (\(n=0, 1, 2)\) for Bitcoin in both regimes as well as in the overall sample period (Those for the benchmarks in the overall sample period are shown in the supplementary information). Each eigenstate of the QHO model is described as a \(\chi\) distribution, and the probability \({P}_{n}\) assigned to each represents a value of the probability assigned to each \(\chi\) distribution26. The state of \(n=3\) and higher is neglected because the values assigned to \({P}_{n}\) are less than \({10}^{-4}\). The result is presented along with daily (\(q=1\)) and other different holding periods (\(q=2, 4, 8, 16\)). Particularly, since a market is efficient when the log return distribution is close to the Gaussian distribution, it can be said that the Bitcoin market follows the EMH based on the value of \({P}_{0}\): that is, the probability allocation in the Gaussian distribution that describes the ground state of the QHO model. Unlike the mixed evidence of the VR test, the result of QHO consistently supports the efficiency of the Bitcoin market: the log of Bitcoin price follows a random walk with a probability of 90% or more.

Discussion

Our results are explained through market capitalization and the speed of information discovery. Table 8 shows that the \(m\omega\) value of Bitcoin is much smaller with the scale being about 1/19 to 1/47 than that of other assets (e.g., commodity, stock, and currency). According to Ahn et al.26, \(m\) can be interpreted as the market capitalization and \(\omega\) as the angular velocity for log return fluctuations. The average market capitalization (\(m\)) of Bitcoin in 2010–2019 is about 1/321 and 1/648 of the gold and S&P 500, respectively. Thus, the oscillating velocity around the equilibrium (\(\omega\)) for Bitcoin is estimated about 17 and 25 times larger than those for the gold and S&P 500, respectively. It implies that information circulation in the Bitcoin market is sufficiently fast compared to others, confirming the efficiency of the Bitcoin market together with the probability assigned to the ground state.

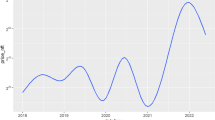

We estimate the probability assigned to the first three low-lying eigenstates for each year. Figure 2 shows that the yearly \({P}_{0}\) value fluctuates over the 90% level. This further confirms the robustness of our results: there is no significant change in the pattern of probability allocation at the ground state by year. This implies that technical analysis of historical price series cannot provide a long-term advantage in the Bitcoin market; future price evolution will be based on new information rather than past price performance. However, the \({P}_{0}\) values in 2013 and 2017 fell to around 88% and 87%, respectively. On the one hand, the decrease in 2013 is regarded as the transition period, shifting the Bitcoin market from a low to a high price regime51. The Bitcoin price, which had been in the tens of US dollars, exceeded USD 1,000 per BTC and burst a market bubble52: in December 2013, the Bitcoin price surged to USD 1,147 per BTC, then plunged by up to 85% in the following year. Moreover, in 2013, Bitcoin production (mined volume) drastically decreased due to increased mining difficulty. This significantly affected the price of Bitcoin on the supply side53. Put differently, during the transition period of the price regime, the strong collective phenomenon together with supply shortage resulted in a decline in the efficiency of the Bitcoin market; the \({P}_{0}\) value supports these arguments well.

Yearly change of the probability allocation in each eigenstate in the Bitcoin market. The black dashed line shows the probability assigned to the ground state (\({P}_{0}\)) while the blue dash-single dotted line and red dotted line describe the probabilities assigned to the first (\({P}_{1}\)) and second excited state (\({P}_{2}\)), respectively. Two shaded areas indicate the periods when \({P}_{0}\) value is estimated below 0.9.

However, in 2017, there was a large increase of public interest in cryptocurrencies, which caused higher levels of uncertainty and induced herding behavior in cryptocurrency markets54. Bouri et al.55 statistically confirmed this by showing that significant herding frequently occurred in 2017 in cryptocurrency markets. Accordingly, in line with Froot et al.56, the decreased \({P}_{0}\) value in 2017 can be explained as follows: many short-term speculators who are new to cryptocurrency herd in the Bitcoin market based on information completely irrelevant to fundamentals. Meanwhile, this increase in irrational speculation was mainly derived from China’s cryptocurrency exchange market which at that time accounted for more than 90% of the global cryptocurrency trading volume. Accordingly, the People’s Bank of China banned domestic cryptocurrency trading and initial coin offerings in September 2017, followed by a drastic cryptocurrency price drop and resurgence a few days after57. Nonetheless, after these strict regulations were imposed, most of the trading volume of cryptocurrencies in China moved elsewhere (e.g., U.S., Japan, and South Korea) and their impact on cryptocurrency prices was ambiguous58. This implies that such strict regulations in cryptocurrencies would not be effective but just increase price uncertainty, affecting their market efficiency, which can also explain the low \({P}_{0}\) value in 2017.

Liquidity increments in the Bitcoin market positively affect market efficiency; particularly, liquidity change plays a central role in the return predictability and, thus, informational efficiency of cryptocurrencies16,18. Generally, liquidity increase improves market efficiency through two channels59,60: first, it enables faster and cheaper transactions, thereby price promptly absorbs available information in the marketplace; second, it encourages investors to easily make tiny- or short-term massive transactions based on private information that barely impacts prices, approximating the market prices to fundamental asset value61,62,63. Therefore, we examine the Amihud illiquidity ratio64 and explain the market efficiency of Bitcoin with the changes in liquidity: Fig. 3 shows that the Bitcoin market’s liquidity keeps increasing gradually, even surpassing the USD/EUR and gold since 2014.

Amihud illiquidity of the Bitcoin, gold, S&P 500, and USD/EUR markets. Following Amihud 63, the monthly illiquidity is estimated using the daily history of trades. The smaller the calculated illiquidity value, the greater the liquidity of the market. The red, yellow, blue, and green lines indicate Amihud illiquidity of the Bitcoin, gold, S&P 500, and USD/EUR markets, respectively. Each colored line is expressed on a log scale for comparison purposes, using data available from September 2010 to March 2019. The shaded area indicates the period of the low-price regime. The trading volume for each asset were retrieved from the following websites: https://data.bitcoinity.org/markets (Bitcoin), https://backtestmarket.com (gold), https://finance.yahoo.com (S&P 500), and https://www.fxcm.com/markets (USD/EUR).

Unlike other assets, Bitcoin has a unique market structure where inelastic supply meets elastic demand since the total issuance (mining volume) is predetermined. Therefore, investors’ reaction to market information has a huge impact on Bitcoin prices. Additionally, year-round 24/7 trading, relatively low transaction costs, and low entry barriers to the market help investors participate freely and make decisions promptly, ultimately facilitating quick information dissemination in the market price. This explains how the Bitcoin market was able to operate close to an efficient market even with a low liquidity level in the early stage, especially during the low price regime in 2010–2012. However, since 2013, the market has stabilized with the birth of multiple exchanges and institutional investors’ interests. Accordingly, the liquidity of the Bitcoin market continued to expand, which has further contributed to market efficiency in the high price regime. Thus, negative factors that inhibit the efficient dissemination of information in the market, such as instability of the initial market system, early government regulations, externalities like hacking, and highly speculative transactions, appear to be offset by the development of the Bitcoin market.

Conclusions

This study examines the market efficiency of Bitcoin. As a first step, the VR test, which is widely used in literature, shows mixed evidence of the Bitcoin market efficiency. However, we confirm that the VR test is not suitable for testing the EMH because its basic assumption is not satisfied in the Bitcoin market: the increments of log price series are not Gaussian white noise. Consequently, we applied the QHO, which provides a general solution for the PDF of the log return. The probability assigned to the ground state indicates that the Bitcoin market is rather close to the efficient market, similar to other asset markets. We explain that the continual increase in the market’s liquidity and the change in price regime (from low to high) contribute to our findings. Additionally, the year-round 24-h trading system contributed to ensuring that market information is well reflected in the market price.

Our results show that the Bitcoin market is close to being weakly efficient, implying that developing a profitable trading strategy simply based on past trends of Bitcoin price is difficult for speculators. Moreover, considering the liquidity and market capitalization, Bitcoin and major altcoins are getting closer to other assets and thus, have a direct/indirect impact on the real economy both now and in the future. Therefore, policymakers should closely monitor Bitcoin’s market efficiency to avoid market failure when implementing policies and regulations that could affect its market size and liquidity or induce investors’ herding behavior.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Fama, E. F. Efficient capital markets: A review of theory and empirical work. J. Finance 25(2), 383–417 (1970).

Kim, H., Yi, E., Lee, D. & Ahn, K. Technological change and market conditions: Evidence from Bitcoin fork. Complexity 2022, 1–7 (2022).

Al-Yahyaee, K. H., Mensi, W. & Yoon, S. M. Efficiency, multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Finance Res. Lett. 27, 228–234 (2018).

Brauneis, A. & Mestel, R. Price discovery of cryptocurrencies: Bitcoin and beyond. Econ. Lett. 165, 58–61 (2018).

Bundi, N. & Wildi, M. Bitcoin and market-(in)efficiency: A systematic time series approach. Digit. Finance 1(1–4), 47–65 (2019).

Caporale, G. M., Gil-Alana, L. & Plastun, A. Persistence in the cryptocurrency market. Res. Int. Bus. Finance 46, 141–148 (2018).

Cheah, E. T., Mishra, T., Parhi, M. & Zhang, Z. Long memory interdependency and inefficiency in Bitcoin markets. Econ. Lett. 167, 18–25 (2018).

Kristoufek, L. On Bitcoin markets (in)efficiency and its evolution. Phys. A 503, 257–262 (2018).

Pappalardo, G., Di Matteo, T., Caldarelli, G. & Aste, T. Blockchain inefficiency in the Bitcoin peers network. EPJ Data Sci. 7(1), 30–42 (2018).

Urquhart, A. The inefficiency of Bitcoin. Econ. Lett. 148, 80–82 (2016).

Kumar, A. S., Nagaraju, T. & Ajaz, T. On the informational efficiency of the cryptocurrency market. IUP J. Appl. Econ. 19(1), 47–56 (2020).

Tiwari, A. K., Jana, R. K., Das, D. & Roubaud, D. Informational efficiency of Bitcoin—an extension. Econ. Lett. 163, 106–109 (2018).

Bariviera, A. F. The inefficiency of Bitcoin revisited: A dynamic approach. Econ. Lett. 161, 1–4 (2017).

Bartos, J. Does Bitcoin follow the hypothesis of efficient market?. Int. J. Econ. Sci. IV(2), 10–23 (2015).

Nadarajah, S. & Chu, J. On the inefficiency of Bitcoin. Econ. Lett. 150, 6–9 (2017).

Sensoy, A. The inefficiency of Bitcoin revisited: A high-frequency analysis with alternative currencies. Finance Res. Lett. 28, 68–73 (2019).

Selmi, R., Tiwari, K. A. & Hammoudeh, S. Efficiency or speculation? A dynamic analysis of the Bitcoin market. Econ. Bull. 38(4), 2037–2046 (2018).

Wei, W. C. Liquidity and market efficiency in cryptocurrencies. Econ. Lett. 168, 21–24 (2018).

Vidal-Tomás, D. & Ibañez, A. Semi-strong efficiency of Bitcoin. Finance Res. Lett. 27, 259–265 (2018).

Khuntia, S. & Pattanayak, J. K. Adaptive market hypothesis and evolving predictability of Bitcoin. Econ. Lett. 167, 26–28 (2018).

Kurihara, Y. & Fukushima, A. The market efficiency of Bitcoin: A weekly anomaly perspective. J. Appl. Finance Bank. 7(3), 57–64 (2017).

Sigaki, H. Y. D., Perc, M. & Ribeiro, H. V. Clustering patterns in efficiency and the coming-of-age of the cryptocurrency market. Sci. Rep. 9(1), 1440 (2019).

Alves, L. G. A., Sigaki, H. Y. D., Perc, M. & Ribeiro, H. V. Collective dynamics of stock market efficiency. Sci. Rep. 10(1), 21992 (2020).

Lo, A. W. & MacKinlay, A. C. Stock market prices do not follow random walks: Evidence from a simple specification test. Rev. Financ. Stud. 1(1), 41–66 (1988).

Aggarwal, D. Do bitcoins follow a random walk model?. Res. Econ. 73(1), 15–22 (2019).

Ahn, K., Choi, M. Y., Dai, B., Sohn, S. & Yang, B. Modeling stock return distributions with a quantum harmonic oscillator. Europhys. Lett. 120(3), 38003 (2017).

Dwyer, G. P. The economics of Bitcoin and similar private digital currencies. J. Financ. Stab. 17, 81–91 (2015).

Brière, M., Oosterlinck, K. & Szafarz, A. Virtual currency, tangible return: Portfolio diversification with bitcoin. J. Asset Manag. 16(6), 365–373 (2015).

Dyhrberg, A. H. Bitcoin, gold and the dollar – A GARCH volatility analysis. Finance Res. Lett. 16, 85–92 (2016).

Pieters, G. & Vivanco, S. Financial regulations and price inconsistencies across Bitcoin markets. Inf. Econ. Policy 39, 1–14 (2017).

Charles, A. & Darné, O. Variance-ratio tests of random walk: An overview. J. Econ. Surv. 23(3), 503–527 (2009).

Jeong, M., Kim, S., Yi, E. & Ahn, K. Market efficiency and information flow between the crude palm oil and crude oil futures markets. Energy Strategy Rev. 45, 101008 (2023).

Ahn, K., Forsyth, J., Jang, H. & Kim, D. Fixed rate mortgages: The cost of interest rate risk aversion. Finance Res. Lett. 44, 102158 (2022).

Ji, G., Kong, H., Kim, W.C. & Ahn, K. 2020 Stochastic volatility and early warning indicator. In Lecture Notes in Computer Science Book Series (LNTCS), Vol. 12137, 413–421 (Springer, Cham).

Jang, H., Song, Y. & Ahn, K. Can government stabilize the housing market? The evidence from South Korea. Phys. A 550, 124114 (2020).

Dai, B., Zhang, F., Tarzia, D. & Ahn, K. Forecasting financial crashes: Revisit to log-periodic power law. Complexity 2018, 4237471 (2018).

Jang, H., Ahn, K., Kim, D. & Song, Y., (2018). Detection and prediction of house price bubbles: Evidence from a new city. In Lecture Notes in Computer Science Book Series (LNTCS) Vol. 10862, 782–795 (Springer, Cham, 2018).

Jang, H., Song, Y., Sohn, S. & Ahn, K. Real estate soars and financial crises: Recent stories. Sustainability 10(12), 4559 (2018).

Kim, C., Kim, D. S., Ahn, K. & Choi, M. Y. Dynamics of analyst forecasts and emergence of complexity: Role of information disparity. PLoS ONE 12(5), e0177071 (2017).

Ji, G., Dai, B., Park, S.-P. & Ahn, K. The origin of collective phenomena in firm sizes. Chaos Solit. Fractals 136, 109818 (2020).

Putz, M. V. Quantum nanochemistry II: Quantum atoms and periodicity (CRC Press, 2016).

Risken, H. 1996 Fokker-Planck equation. In: The Fokker-Planck Equation. Risken, H. (Edn.) (Springer, London)

Arfken, G. B. & Weber, H. J. Mathematical Methods for Physicists (Academic Press, London, 1995).

Takaishi, T. & Adachi, T. Market efficiency, liquidity, and multifractality of Bitcoin: A dynamic study. Asia-Pac. Financ. Mark. 27(1), 145–154 (2020).

Alvarez-Ramirez, J., Rodriguez, E. & Ibarra-Valdez, C. Long-range correlations and asymmetry in the Bitcoin market. Phys. A 492, 948–955 (2018).

Corbet, S. & Katsiampa, P. Asymmetric mean reversion of Bitcoin price returns. Int. Rev. Financ. Anal. 71, 101267 (2020).

Yi, E., Ahn, K. & Choi, M. Y. Cryptocurrency: Not far from equilibrium. Technol. Forecast. Soc. Change 177, 121424 (2022).

Punzo, A. & Bagnato, L. Modeling the cryptocurrency return distribution via Laplace scale mixtures. Phys. A 563, 125354 (2021).

Begušić, S., Kostanjčar, Z., Stanley, H. E. & Podobnik, B. Scaling properties of extreme price fluctuations in Bitcoin markets. Phys. A 510, 400–406 (2018).

Drożdż, S., Gȩbarowski, R., Minati, L., Oświȩcimka, P. & Wa Torek, M. Bitcoin market route to maturity? Evidence from return fluctuations, temporal correlations and multiscaling effects. Chaos 28(7), 071101 (2018).

Lahmiri, S. & Bekiros, S. Chaos, randomness and multi-fractality in Bitcoin market. Chaos Solit. Fractals 106, 28–34 (2018).

Bouri, E., Gupta, R., Tiwari, A. K. & Roubaud, D. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Res. Lett. 23, 87–95 (2017).

Lee, N.-K., Yi, E. & Ahn, K. Boost and burst: Bubbles in the Bitcoin market. Lect. Notes Comput. Sci. 12137, 422–431 (2020).

Gurdgiev, C. & O’Loughlin, D. Herding and anchoring in cryptocurrency markets: Investor reaction to fear and uncertainty. J. Behav. Exp. Finance 25, 100271 (2020).

Bouri, E., Gupta, R. & Roubaud, D. Herding behaviour in cryptocurrencies. Finance Res. Lett. 29, 216–221 (2019).

Froot, K. A., Scharfstein, D. S. & Stein, J. C. Herd on the street: Informational inefficiencies in a market with short-term speculation. J. Finance 47(4), 1461–1484 (1992).

Xie, R. Why China had to ban cryptocurrency but the U. S. did not: comparative analysis of regulations on crypto-markets between the U. S. and China. Wash. U. Global Stud. L. Rev. 18(2), 457–492 (2019).

Feinstein, B. D. & Werbach, K. The impact of cryptocurrency regulation on trading markets. J. Financ. Regul. 7, 48–99 (2021).

Choi, G., Park, K., Yi, E. & Ahn, K. Price fairness: Clean energy stocks and the overall market. Chaos Solit. Fractals 168, 113049 (2023).

Kim, H., Ha, C. Y. & Ahn, K. Preference heterogeneity in Bitcoin and its forks’ network. Chaos Solit. Fractals 164, 112719 (2022).

Chordia, T., Roll, R. & Subrahmanyam, A. Liquidity and market efficiency. J. Financ. Econ. 87(2), 249–268 (2008).

Chung, D. & Hrazdil, K. Liquidity and market efficiency: A large sample study. J. Bank. Finance 34(10), 2346–2357 (2010).

Young, N. & Auret, C. Liquidity and the convergence to market efficiency. Invest. Anal. J. 47(3), 209–228 (2018).

Amihud, Y. Illiquidity and stock returns: Cross-section and time-series effects. J. Financ. Mark. 5(1), 31–56 (2002).

Funding

This work was supported by (i) the National Research Foundation of Korea grant funded by the Korea government (MSIT) (No. 2022R1A2C100425811, Kwangwon Ahn) and (ii) the Sogang University Research Grant (No. 202210030.01, Sungbin Sohn).

Author information

Authors and Affiliations

Contributions

Study conception and design: E.Y., S.S., K.A. Data collection and cleaning: E.Y., B.Y., M.J. Data analysis and interpretation: E.Y., B.Y., M.J. Drafing the manuscript: E.Y., B.Y., M.J., S.S., K.A. All authors read and approved the fnal manuscript. S.S. and K.A. jointly directed this work.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Yi, E., Yang, B., Jeong, M. et al. Market efficiency of cryptocurrency: evidence from the Bitcoin market. Sci Rep 13, 4789 (2023). https://doi.org/10.1038/s41598-023-31618-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-023-31618-4

This article is cited by

-

COVID-19 and REITs Crash: Predictability and Market Conditions

Computational Economics (2024)

-

Is Bitcoin ready to be a widespread payment method? Using price volatility and setting strategies for merchants

Electronic Commerce Research (2024)

-

After the Split: Market Efficiency of Bitcoin Cash

Computational Economics (2023)

Comments

By submitting a comment you agree to abide by our Terms and Community Guidelines. If you find something abusive or that does not comply with our terms or guidelines please flag it as inappropriate.