Abstract

Financial technology (FinTech) and financial inclusion have become increasingly significant as means to alleviate poverty, reduce income inequality, and promote economic growth. This study presents a bibliometric analysis of research on the role of digital financial services in promoting financial access and economic development between 2010 and 2023. Using Scopus database, 695 documents were selected, and Biblioshiny and VOSviewer software were employed for analysis. The study aims to identify research themes, analyze publication trends, assess geographical distribution, recognize influential authors, institutions, and journals, uncover highly cited articles, and determine research gaps. The results reveal a growing interdisciplinary interest in FinTech and financial inclusion, with a surge in research production since 2016, emphasizing the significance of digital financial services in addressing the limitations of traditional financial institutions. The findings also highlight influential authors, institutions, and publications that have shaped the discourse, global collaboration patterns, and emerging research themes and trends. Policymakers are encouraged to foster an environment conducive to the growth and integration of FinTech, while future research directions should focus on the impact of digital financial services on vulnerable populations, alternative financing solutions, and the potential of emerging technologies in advancing financial inclusion and economic development. This analysis underscores the importance of interdisciplinary collaboration, global cooperation, and vigilance in addressing the challenges and opportunities presented by the rapid adoption of digital financial services in promoting inclusive and sustainable economic development.

Similar content being viewed by others

Introduction

The rapid evolution of financial technology (FinTech) has transformed the financial services industry, creating new opportunities for financial inclusion and economic development. FinTech refers to the innovative use of technology in the design and delivery of financial products and services (Morse, 2015). The emergence of FinTech has accelerated financial innovation, enhanced the efficiency of financial services, and expanded the reach of financial institutions, particularly in underserved markets (Chen et al., 2020). As a result, the potential role of FinTech in promoting financial access and economic development has attracted considerable attention from researchers, policymakers, and practitioners. Financial inclusion, defined as the availability and accessibility of financial services to all segments of society, is a key enabler of sustainable economic growth and poverty reduction (Demirgüç-Kunt et al., 2018). Despite significant progress in recent years, an estimated 1.7 billion adults still lack access to formal financial services, with the majority residing in low- and middle-income countries (World Bank, 2014). Financial exclusion exacerbates income inequality, limits economic opportunities, and perpetuates the cycle of poverty (Banerjee and Duflo, 2011). FinTech emerged as a result of the convergence of financial services and digital technology, encompassing a wide range of applications, such as mobile banking, peer-to-peer lending, digital payments, and blockchain-based solutions (Zavolokina et al., 2016). Over the past decade, FinTech has grown rapidly, disrupting traditional financial institutions and reshaping the way individuals and businesses access and use financial services (Arner et al., 2017a).

FinTech innovations have significant potential to address the barriers to financial inclusion, such as lack of physical access to financial institutions, high costs, and complex requirements associated with traditional financial services (Bhattacharya et al., 2020). By leveraging digital technologies, FinTech firms can offer more affordable, accessible, and tailored financial products and services to underserved populations, including low-income individuals, women, and rural residents (Kim et al., 2020). For instance, mobile money services have enabled millions of unbanked individuals in developing countries to access basic financial services, such as savings, remittances, and credit, through their mobile phones (Suri, 2017). Similarly, peer-to-peer lending platforms have democratized access to credit by connecting borrowers directly with investors, bypassing traditional intermediaries and reducing borrowing costs (Zhang et al., 2015). Blockchain technology, on the other hand, has the potential to enhance financial inclusion by facilitating secure, transparent, and cost-effective transactions and record-keeping (Tapscott and Tapscott, 2016).

This study presents a nuanced focus on FinTech’s role in advancing financial inclusion and promoting economic development, an aspect not deeply explored in the comprehensive analysis of Li and Xu (2021). Whereas Li and Xu conducted a broad bibliometric analysis on FinTech as a whole, our research narrows down to understand better how digital financial services contribute to economic development and financial accessibility. This granular focus offers unique insights not captured in their broad approach. Furthermore, our research extends to 2023, thereby encompassing more recent developments in the FinTech space that were outside the scope of Li and Xu’s study, which ended in 2021. In addition, the Scopus database, as utilized in our research, diverges from the Web of Science database that Li and Xu employed. Different databases often yield different document sets and thus can provide distinctive insights into the field of study. This study also advances one step further by identifying research gaps and suggesting potential directions for future investigation, a valuable addition to the academic community that seeks unexplored avenues. Moreover, this study provides policy recommendations designed to foster an environment conducive to FinTech’s growth, a policy-oriented approach that adds practical relevance to the study, making it not only academically interesting but also beneficial for policymakers and practitioners. This study emphasis on the importance of interdisciplinary collaboration and global cooperation in addressing the challenges and opportunities presented by the rapid adoption of digital financial services adds a unique perspective not evident in the study by Li and Xu (2021). Thus, while both studies contribute to the rapidly evolving field of FinTech, this research offers a specific focus, employs a different database, covers a more recent time span, provides policy recommendations, and underscores the importance of interdisciplinary and global approaches.

Objectives of the study

Given the growing interest in FinTech and financial inclusion, a large and diverse body of research has emerged on the topic. However, understanding the scope, trends, and key findings of this research remains a challenge due to the interdisciplinary nature of the field and the rapid pace of technological advancements. A bibliometric analysis can help address this challenge by systematically mapping the research landscape, revealing patterns in the publication output, citation activity, authorship, and research themes.

The objective of this bibliometric analysis is to provide a comprehensive overview of the research on the role of digital financial services in promoting financial access and economic development. Specifically, the study aims to:

-

1.

Identify the main research themes and emerging topics in the field.

-

2.

Analyze the trends in publication output and citation activity over time.

-

3.

Assess the geographical distribution of publications and research collaboration.

-

4.

Recognize the most influential authors, institutions, and journals in the field.

-

5.

Uncover the highly cited articles and their main findings.

-

6.

Determine research gaps and potential avenues for future investigation.

Scope of the study

Although FinTech encompasses a wide range of technological innovations in the financial sector, this study focuses on the role of digital financial services in promoting financial access and economic development. Digital financial services refer to a subset of FinTech that includes mobile money, digital payments, peer-to-peer lending, crowdfunding, and other technology-driven financial services that are accessible through digital platforms, such as mobile phones, computers, and other internet-enabled devices.

The bibliometric analysis covers research articles published in academic journals, conference proceedings, and other scholarly outlets indexed in major databases, such as Web of Science, Scopus, and Google Scholar. The study period is determined by the availability of data and the most recent developments in the field, with a focus on the research published from the early 2000s to the present. The analysis excludes books, book chapters, and other non-peer-reviewed publications, as well as research that does not directly address the role of digital financial services in promoting financial access and economic development.

The bibliometric analysis also takes into account the interdisciplinary nature of the research on FinTech and financial inclusion, encompassing fields such as economics, finance, information systems, business, and development studies. By focusing on the intersection of these disciplines, the study aims to provide a comprehensive and nuanced understanding of the research landscape on the role of digital financial services in promoting financial access and economic development.

Review of literature

Financial technology (FinTech) has emerged as a significant force in shaping the financial landscape, particularly in promoting financial inclusion. The rapid advancements in digital technology have enabled a proliferation of innovative solutions to address financial access barriers and foster economic development. This literature review aims to provide a comprehensive understanding of the existing research on FinTech and financial inclusion, exploring key findings, trends, and gaps in the research. By analyzing the current research landscape, this review sets the context for a bibliometric analysis and highlights the importance of understanding the impact of digital financial services on financial access and economic development. The term “FinTech” was first coined in the late 20th century, with technological innovations such as electronic trading platforms and automated teller machines (ATMs) revolutionizing traditional banking and financial services (Gomber et al., 2017). The early stages of FinTech were characterized by the automation of financial processes, and the term became synonymous with the digitalization of the financial industry (Zavolokina et al., 2016). In the early 21st century, the rise of the internet and mobile technology fueled the growth of digital financial services, which enabled the delivery of financial services to previously underserved populations (GSMA, 2017). Mobile money, for instance, revolutionized the way people in developing countries accessed and managed their finances, providing an affordable and accessible alternative to traditional banking (Jack and Suri, 2014). As FinTech innovations continued to expand, the potential for leveraging digital technology to promote financial inclusion became increasingly evident. The World Bank (2014) highlighted the role of FinTech in accelerating financial access, emphasizing the importance of digital financial services in empowering underserved populations and fostering economic growth. This marked the beginning of a new era in which FinTech and financial inclusion became inextricably linked.

The diffusion of digital financial services has been studied extensively in the context of technology adoption models. The Technology Acceptance Model (TAM) (Davis, 1989) and the Unified Theory of Acceptance and Use of Technology (UTAUT) (Venkatesh et al., 2003) are two prominent frameworks that have been employed to analyze the factors influencing the adoption of FinTech services. These models emphasize the role of perceived usefulness, perceived ease of use, and social influence in shaping users’ attitudes and intentions towards digital financial services (Shaikh and Karjaluoto, 2015). Financial inclusion research has focused on understanding the barriers and drivers of access to financial services. The Access, Usage, and Quality (AUQ) framework (Cull et al., 2009) and the Financial Inclusion Index (Global Findex) (Demirgüç-Kunt et al., 2018) are two widely used frameworks for assessing financial inclusion levels. These frameworks emphasize the need for accessible, affordable, and high-quality financial services to promote financial access and economic development.

There is a growing body of literature that highlights the positive impact of digital financial services on financial access. For example, Suri and Jack (2016) found that the adoption of mobile money in Kenya significantly increased financial access, particularly for women and rural populations. Similarly, Batista and Vicente (2018) demonstrated that the introduction of mobile banking in Mozambique improved financial access for low-income individuals, while Mbiti and Weil (2016) reported that mobile money services in Tanzania led to increased access to savings and credit facilities. FinTech innovations have also been shown to contribute to improved financial literacy, which is a key determinant of financial inclusion. For example, Carpena et al. (2011) found that digital financial education programs in India and the Philippines led to increased financial knowledge and better financial decision-making among participants. Similarly, Xu and Zia (2012) demonstrated that mobile-based financial education programs in South Africa significantly improved participants’ financial literacy levels.

The impact of FinTech on economic development has also been a subject of extensive research. Studies such as Aker et al. (2016) have demonstrated that mobile money services can lead to increased agricultural productivity and income growth in rural areas. Other research, such as Gutiérrez and Singh (2013), has shown that digital financial services can contribute to economic growth by facilitating the flow of remittances, reducing transaction costs, and fostering entrepreneurship. The regulatory environment plays a crucial role in the adoption and success of FinTech innovations in promoting financial inclusion. Research by Arner et al. (2015) and Zetzsche et al. (2017a) highlights the importance of developing a supportive and flexible regulatory framework that can adapt to the rapid evolution of digital financial services. Moreover, studies such as Chen et al. (2019) emphasize the need for regulatory authorities to balance innovation with the protection of consumers and the stability of the financial system. The bibliometric analysis on FinTech and financial inclusion finds resonance with several other works in the field. Rakshit et al. (2021) underscore the role of sentiment analytics in digital finance. The behavioral finance research by Sajeev et al. (2021) reiterates the impact of FinTech on investor behavior. Afjal’s (2022) study on Bitcoin’s volatility elucidates the complexities of the financial ecosystem within the FinTech landscape. Moreover, Afjal et al. (2023) probe into the interplay between FinTech, energy consumption, and environmental sustainability, hinting at wider implications of FinTech. Nagarajan and Afjal (2023) provide insights into the potential of blockchain technology in financial services. Lastly, Trivedi et al. (2022) underline the effect of external shocks, like the COVID-19 pandemic, on financial markets, accentuating the need for adaptability.

Another area of interest within the literature is the role of FinTech in promoting financial resilience and crisis management. As financial systems have become increasingly interconnected and complex, understanding how digital financial services can help individuals and institutions manage and recover from economic shocks is crucial. FinTech innovations, particularly digital payment systems, have been used to facilitate rapid and targeted responses to economic crises, natural disasters, and pandemics. For instance, during the COVID-19 pandemic, governments worldwide leveraged digital financial services to deliver emergency cash transfers and social safety net payments to vulnerable populations (Gentilini et al., 2020). The ability of FinTech solutions to promote financial resilience by enabling individuals and businesses to better manage financial risks is another important area of research. Studies have shown that digital financial services, such as mobile money and peer-to-peer lending platforms, can help individuals and SMEs diversify income sources, manage cash flows, and access emergency funds, thus increasing their ability to cope with economic shocks. The impact of FinTech on the stability of the financial system as a whole is also an important topic of investigation. While some research suggests that FinTech innovations can enhance financial stability by reducing reliance on traditional intermediaries and increasing competition (Liang et al., 2017), other studies highlight the potential risks and challenges associated with the rapid growth of digital financial services, such as cybersecurity threats, fraud, and systemic risks (Brière et al., 2020).

Materials and methods

The investigation was executed utilizing a pre-established search query within the Scopus database, with the retrieved results being imported into reference management software. In formulating the search string for this study, a combination of keywords and terms employed that are commonly used in research focusing on the interplay between financial technology and financial inclusion. These keywords are designed to cover the broad spectrum of concepts in the realm of FinTech and its role in economic development and poverty reduction. This approach to query formation is consistent with best practices in bibliometric analysis as it provides a comprehensive and inclusive search (Aria and Cuccurullo, 2017). A variety of filters were employed to refine these findings. The primary filter constituted a temporal range constraint, encompassing documents published from 2010 to 2023. The secondary filter pertained to subject domains, encompassing Economics, Econometrics, and Finance; Social Sciences; Business, Management, and Accounting; Computer Science; and Environmental Science. The tertiary filter involved document classification, specifically incorporating articles and conference papers. The ultimate filter addressed language, including solely English-language documents.

Search string

TITLE-ABS-KEY ((“financial technology” OR “FinTech” OR “digital financial services” OR “mobile banking” OR “mobile money” OR “digital finance” OR “digital payments” OR “peer-to-peer lending”) AND (“financial inclusion” OR “financial access” OR “unbanked” OR “underbanked” OR “banking the unbanked” OR “economic development” OR “poverty reduction” OR “financial empowerment” OR “financial literacy”)) AND PUBYEAR > 2009 AND PUBYEAR < 2024 AND (LIMIT-TO, (“ECON”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “BUSI”)) AND (LIMIT-TO (DOCTYPE, “ar”) OR LIMIT-TO (DOCTYPE, “cp”)) AND (LIMIT-TO (LANGUAGE, “English”)).

The given search string is designed to perform a bibliometric analysis on the research topic “Bridging the Financial Divide: A Bibliometric Analysis on the Role of Digital Financial Services within FinTech in Enhancing Financial Inclusion and Economic Development.” The search string is constructed using a combination of keywords, filters, and Boolean operators to ensure the retrieval of relevant literature for the analysis.

PRISMA statement

Following the application of the search string, the “Preferred Reporting Items for Systematic Reviews and Meta-Analysis” (PRISMA statement) was employed to meticulously refine the search outcomes (Page et al., 2020; Haddaway et al., 2022). This entire procedure is depicted in Fig. 1. The rationale for adopting the PRISMA statement stemmed from its capacity to enhance dependability across diverse reviews, its commendation founded upon its exhaustiveness, and the recent surge in its utilization within numerous bibliometric investigations.

The study’s objective was to pinpoint pertinent documents within the Scopus database, adhering to predefined parameters. The search was conducted systematically, with the results undergoing refinement through the application of diverse filters. The initial search yielded 1174 documents from the Scopus database. A subset of these documents, numbering 906, comprised English-language articles and conference papers published between 2010 and 2023, spanning the subject areas of Economics, Econometrics, and Finance; Social Sciences; Business, Management, and Accounting; Computer Science; and Environmental Science. The established criteria and filters were employed to condense the search results to a more manageable collection of germane documents, suitable for subsequent analysis or review.

Additional filters were applied, resulting in 697 records post-data cleansing, with the exclusion of 209 documents. A total of 695 articles and abstracts were deemed eligible, while two reports were omitted due to the unavailability of their abstracts. Ultimately, 695 studies met the inclusion requirements and were incorporated into the bibliometric analysis.

In the present study, the robust bibliometric analysis tool, Bibliometrix®, was employed for comprehensive examination. Bibliometric analyses should encompass various aspects, including descriptive and collaborative network analyses such as co-citation, bibliographic coupling, and co-occurrence testing (Aria and Cuccurullo, 2017). Bibliometrix® delivers an extensive assessment of scientific mapping, utilizing the biblioshiny interface (Aria and Cuccurullo, 2017). Moreover, VOSviewer is adept at managing substantial datasets, offers superior mapping features, and presents enhanced display options (Martínez-López et al., 2018; Donthu et al., 2020). Both tools cater to the full spectrum of functions investigated within this research.

Results

Analysis using Biblioshiny

Firstly, the analyses commenced with the innovative utilization of Biblioshiny, a powerful and user-friendly web application designed to simplify the bibliometric process. This state-of-the-art tool streamlines the extraction, organization, and visualization of complex research data, enabling researchers to effectively examine intricate patterns and trends in the vast realm of academic literature. By leveraging Biblioshiny’s capabilities, our study delves into the FinTech and financial inclusion landscape, unearthing valuable insights and fostering a deeper understanding of how digital financial services are reshaping access to financial resources and driving economic development.

After extraction from the Scopus database, the dataset comprising articles on FinTech and Financial Inclusion is presented in Table 1. This compilation exported from Biblioshiny and offers valuable insights pertaining to the research analysis in this domain.

Production and most important journals in FinTech and financial inclusion

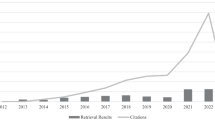

The provided Fig. 2 represents a research production on the role of digital financial services in promoting financial access and economic development. It highlights the number of articles published per year on financial technology (FinTech) and financial inclusion in the most important journals in the field, spanning from 2010 to 2023. The data reveals an increasing trend in the number of published articles, which indicates a growing interest in the subject matter. This can be attributed to rapid advancements in financial technology and the increasing recognition of the importance of financial inclusion in achieving economic growth and poverty reduction.

Between 2010 and 2014, the research field experienced a slow but steady increase in the number of published articles, reflecting the early stages of exploration in the field. In 2015, there was a slight decrease in the number of articles, potentially due to fluctuations in research interest or funding. However, from 2016 to 2021, a significant surge in the number of publications occurred, reflecting the rapid development of FinTech solutions and the growing awareness of their potential in promoting financial inclusion. This trend continued in 2022, with a dramatic increase in the number of articles, which might be attributed to the expansion of FinTech applications and research on their impact on financial inclusion, as well as the growing importance of this subject in the context of economic development and sustainability.

It’s important to note that the data for 2023 only includes 77 articles. As the year is not yet complete, the number of publications is expected to increase by the end of the year. In conclusion, the table showcases the growing interest and research production in the field of FinTech and financial inclusion. This trend highlights the significance of digital financial services in promoting financial access and economic development, which serves as the focus of your research paper.

Average citation per year

The provided Fig. 3 offers a bibliometrics analysis of research production on digital financial services in promoting financial access and economic development, focusing specifically on the average citations per year for each year between 2010 and 2023. The table highlights the mean total citations per article and per year, providing insights into the reception and influence of research on FinTech and financial inclusion within the academic community.

From Fig. 3, it can be observed that the citation impact of articles published in earlier years (2010–2012) is generally higher than those published in later years. This is an expected outcome, as older articles have had more time to accumulate citations. The citation impact of articles published between 2013 and 2018 remains relatively stable, with a slight peak in 2016 and 2017. This could be attributed to the growing interest in FinTech and financial inclusion during these years, resulting in more citable research.

However, there is a noticeable decrease in citation impact for articles published in more recent years (2019–2023). This can be attributed to the fact that newer articles have had less time to accrue citations. It is important to consider that the citation impact of these articles may increase in the coming years as they receive more attention from the academic community. It is essential to note that the citation impact of more recent articles is likely to evolve over time.

Most relevant sources

The provided Fig. 4 presents a bibliometrics analysis of the most relevant sources for research on the role of digital financial services in promoting financial access and economic development. It showcases the top 10 sources, ranked by the number of articles published on the topic of FinTech and financial inclusion, highlighting the key publications in the field. The most relevant source for research in this area is “Sustainability (Switzerland),” with 43 articles published on the topic. This suggests that the journal has a strong focus on FinTech and financial inclusion, likely due to the interdisciplinary nature of sustainability research and the increasing importance of financial inclusion in the context of sustainable development.

Other sources contribute significantly to the research field, encompassing a diverse range of disciplines. These include economics and finance journals such as “Cogent Economics and Finance,” “International Journal of Bank Marketing,” “International Journal of Social Economics,” “Finance Research Letters,” and “Applied Economics Letters.” The list also features publications related to technology forecasting and social change (“Technological Forecasting and Social Change”), telecommunications policy (“Telecommunications Policy”), enterprise development and microfinance (“Enterprise Development and Microfinance”), and development studies (“World Development”).

The analysis of the most relevant sources for research on the role of digital financial services in promoting financial access and economic development serves as a valuable reference for researchers seeking to publish their work in reputable and influential outlets. These sources demonstrate the interdisciplinary nature of the research field and highlight the growing importance of FinTech and financial inclusion in a variety of academic disciplines.

Sources’ production over time

The analysis of Table 2 highlights a discernable trend of increasing scholarly interest and output in the field of FinTech and financial inclusion. The rapid proliferation of research in recent years underscores the growing recognition of the crucial role that digital financial services play in fostering financial access and bolstering economic development. Furthermore, this table substantiates the importance of the top six journals in shaping and advancing the discourse in this emergent and increasingly consequential domain of study.

The table under examination, Table 2, elucidates the evolution of research production in the domain of Financial technology (FinTech) and financial inclusion, specifically focusing on the output of the top six academic journals in this field. The table spans from 2010 to 2023 and delineates the publication count for each journal as well as the cumulative total and respective percentage share of the publications. The six preeminent journals that constitute the crux of this analysis are Sustainability, Cogent Economics and Finance (CEF), Technological Forecasting and Social Change (TFSC), Telecommunications Policy (TP), International Journal of Bank Marketing (IJBM), and International Journal of Social Economics (IJSE).

A gradual upsurge in research production can be observed from 2016 onward, with the number of published articles displaying a consistent annual increase. The most significant growth transpired between 2017 and 2023, with the total number of published articles amplifying from a meagre three in 2017 to an impressive 98 in 2023. The year 2023 stands out as a zenith in research output, with all six journals experiencing a heightened level of scholarly contributions.

Among the six journals, Sustainability emerges as the most prolific contributor to the field, accounting for 41.11% of the total publications. In contrast, the International Journal of Social Economics occupies the lowest rung, with a 10.74% share of the published articles. The remaining four journals—Cogent Economics and Finance, Technological Forecasting and Social Change, Telecommunications Policy, and International Journal of Bank Marketing—exhibit varying degrees of contribution, with their respective percentages ranging between 8.89 and 16.67%.

Figure 5 also illustrates the sources’ production over time for research on the role of digital financial services in promoting financial access and economic development, focusing on the top six most relevant sources from 2010 to 2023. It is evident from Fig. 5 that the initial years, ranging from 2010 to 2012, witnessed a dearth of scholarly contributions in the field, with no articles published. However, a nascent emergence of research interest becomes apparent in 2013, with the publication of a solitary article in Telecommunications Policy. The following years, 2014 and 2015, also saw a modest increment, with one article published each year in the same journal.

Most relevant author’s production over time

The provided, Fig. 6, showcases the top 10 authors’ production over time in the research field of Financial technology (FinTech) and financial inclusion, specifically on the role of digital financial services in promoting financial access and economic development. The analysis of the top authors’ production over time is crucial for understanding the key researchers driving this field and identifying potential collaborators.

Wang X is the most productive author, with a total of 9 articles and a fractionalized count of 3.75. Asongu SA follows closely with 7 articles and a fractionalized count of 3. Other authors, such as Chen Y, Okello Candiya Bongomin G, Ahmad AH, Chen S, Iheanachor N, Ozili PK, Zhao Y, and Al-Okaily M, also contribute significantly to the research field.

The fractionalized count of articles takes into account shared authorship, giving partial credit to each author depending on their contribution to the publication. This metric provides a more accurate representation of the authors’ research output and their impact on the field.

By analyzing the production of the top 10 authors in the field of FinTech and financial inclusion, we can gain insights into the research trends and topics they are focused on. This information is beneficial for researchers who aim to engage with the leading experts in the field and build upon their work to contribute to the existing body of knowledge on the role of digital financial services in promoting financial access and economic development.

Authors’ production over time

Figure 7 illustrates the top 10 authors’ scholarly output over time in the domain of Financial Technology (FinTech) and financial inclusion, with an emphasis on digital financial services’ role in fostering financial accessibility and economic growth. The figure provides data on the authors, publication years, total citations (TC), and annual citation rates (TCpY).

Wang X stands out as the most prolific author, with publications from 2020 to 2022 exhibiting diverse citation counts and yearly citation rates. Wang X’s peak TC occurred in 2020 with 45 citations and a corresponding TCpY of 11.25. Asongu SA, another noteworthy contributor, has a publication history spanning from 2018 to 2022. Their highest TC was 23 in 2020, accompanied by a TCpY of 5.75. Chen Y’s work ranges from 2020 to 2023, with their most notable TC of 160 in 2020 and a TCpY of 40. Okello Candiya Bongomin G’s publications, dating from 2018 to 2022, achieved their highest TC of 101 in 2018 and a TCpY of 16.83. Other authors, including Chen S, Ahmad AH, Ozili PK, Iheanachor N, and Zhao Y, also display diverse citation counts and annual citation rates.

Examining the top 10 authors’ total citations and yearly citation rates offers valuable insights into the significance and impact of their research within the FinTech and financial inclusion field. By exploring their scholarly production over time, researchers can pinpoint pivotal contributions and gain a deeper understanding of the research landscape’s evolution, focusing on key themes and influential publications.

Author’s local impact by H Index

Figure 8 presents the local impact of authors in the research domain of Financial Technology (FinTech) and financial inclusion, with a focus on the role of digital financial services in promoting financial access and economic development, as measured by the H-Index. The H-Index is a valuable metric that captures both productivity and the impact of a researcher’s work by considering the number of publications and citations.

In Fig. 8, the H-Index of each author is displayed, along with their G-Index, M-Index, total citations (TC), number of publications (NP), and the year of their first publication (PY_start). Asongu SA, for example, has an H-Index of 4, a G-Index of 7, an M-Index of 0.67, 66 total citations, 7 publications, and began publishing in this area in 2018. Chen Y has a similar H-Index of 4, but with a G-Index of 6, an M-Index of 1, 217 total citations, and 6 publications since 2020.

The H-Index provides insights into the influence and relevance of each author’s research in the field of FinTech and financial inclusion. Higher H-Index values indicate that an author has a greater number of highly cited publications, signaling a more significant impact on the research community. The G-Index, M-Index, total citations, and the number of publications further illustrate each author’s scholarly contributions, allowing for a comprehensive understanding of their local impact within the research landscape. By examining these metrics, researchers can identify key contributors and their influence within the field, helping to recognize essential research topics and publications that have shaped the discourse on FinTech and financial inclusion.

Table 3 presents a comprehensive analysis of the top 10 authors within the realm of Financial technology (FinTech) and financial inclusion research. The table is divided into three distinct categories: Most Relevant Authors, Author Local Impact, and Most Local Cited Authors. Each category evaluates the authors based on distinct metrics, thereby offering a holistic view of their prominence and influence in the field. The first category, Most Relevant Authors, ranks authors by the total number of articles published (AP). Wang X emerges as the most prolific author, with nine articles to his credit, followed by Asongu SA with seven articles. Chen Y and Okello C.B.G are tied with six articles each, while the remaining authors in this category have published between four and five articles. This category highlights the authors who have significantly contributed to the body of knowledge in the field of FinTech and financial inclusion.

The second category, Author Local Impact, gauges the influence of authors on the basis of their H-index (h_index) and their regional affiliation (Element). The H-index is a widely recognized metric that quantifies both the productivity and impact of a researcher’s publications by considering the number of citations they receive. The table showcases six authors with an H-index of 4 and four authors with an H-index of 3. Asongu SA, Banna H, Chen Y, and Okello C.B.G boast the highest H-index values, signifying that their work has had a substantial impact within the academic community.

The third and final category, Most Local Cited Authors, assesses the authors’ influence by examining the total number of citations (TC) their work has garnered and their most locally cited (MLC) status. Ozili PK leads this category with a remarkable 439 citations, followed by Brooks S and Gabor D, each with 261 citations. The MLC column enumerates the number of times an author’s work has been cited by other researchers within their local research community, with the highest MLC value being 3.

Table 3 provides valuable insights into the leading authors in the field of FinTech and financial inclusion, emphasizing their scholarly contributions, local impact, and citation influence. By examining these three distinct categories, the table accentuates the importance of these authors in shaping the discourse and advancing knowledge within the realm of digital financial services and their role in promoting financial access and economic development.

Most global cited documents

Figure 9 presents the most globally cited documents in the research domain of Financial Technology (FinTech) and financial inclusion, emphasizing the role of digital financial services in promoting financial access and economic development. The table highlights the papers, total citations, total citations per year (TC per Year), and normalized total citations (Normalized TC) for each document.

The paper by Ozili (2018) published in 2018 in the Borsa Istanbul Review, has the highest total citations (364) and citations per year (60.67), indicating its significant impact on the research community. The paper also has a high normalized total citation value of 11.40, further emphasizing its relevance within the field.

Another noteworthy paper is by Gabor (2017), published in 2017 in the New Political Economy, with 261 total citations and 37.29 citations per year. Its normalized total citation value is 6.93, which also underscores its importance in the domain.

Other highly cited papers include Chen Y’s 2020 paper in the Journal of Business Venturing Insights, and Munyegera GK’s 2016 paper in World Development. These papers have relatively high total citations, citations per year, and normalized total citations, reflecting their influence and recognition within the research community.

By examining the most globally cited documents, researchers can identify the pivotal publications that have significantly contributed to shaping the discourse on FinTech and financial inclusion. These highly cited papers indicate the key topics, theories, and findings that have resonated with the research community and have the potential to guide future investigations in this area.

Table 4 delineates the most globally cited documents within the field of Financial technology (FinTech) and financial inclusion. This table offers a nuanced perspective on the most influential scholarly contributions, highlighting their impact and relevance within the research community. The table presents a list of ten research papers, outlining the publication year, total citations (TC), citations per year (TC per Year), and normalized total citations (Normalized TC).

The paper with the highest total citation count, as well as the highest normalized citation value, is “Ozili PK, 2018, Borsa Istanbul Review,” amassing a remarkable 364 citations and a normalized citation score of 11.40. The high normalized citation value signifies that this paper has garnered considerable attention and recognition within the academic community. Furthermore, the paper has a striking citation rate of 60.67 citations per year, reflecting its strong impact and relevance in the field of FinTech and financial inclusion. The second most globally cited paper is “Gabor D, 2017, New Political Economy,” with 261 total citations, a citation rate of 37.29 per year, and a normalized citation score of 6.93. This paper, like the aforementioned work by Ozili, has exerted a significant influence on the research community and has contributed profoundly to the body of knowledge in the domain. Other noteworthy papers featured in Table 4 include “Zins A, 2016, Review of Development Finance,” with 207 total citations, and “Li J, 2020, Economic Modelling,” with 183 total citations. These publications exhibit high citation rates of 25.88 and 45.75 per year, respectively, as well as normalized citation scores of 5.45 and 9.64. The remaining papers in the table also display commendable citation counts and normalized citation values, highlighting their contributions to the scholarly discourse on FinTech and financial inclusion. The list features works published between 2012 and 2020, indicating the ongoing interest in and evolution of this research area.

Table 5 delves into the most locally cited documents within the realm of Financial technology (FinTech) and financial inclusion. This table emphasizes the significance of these publications within their local research communities, providing a more nuanced understanding of their impact and relevance. The table lists ten documents, detailing the year of publication, local citations, global citations, the ratio between local and global citations, normalized local citations, and normalized global citations.

The first document, “Allen F, 2014, Journal of African Economics,” has garnered three local citations and 118 global citations. With a local-to-global citation ratio of 2.5, this paper exhibits a substantial impact both locally and globally. The normalized local and global citation values of 11 and 5.90, respectively, further underscore its importance within the academic community. “Asongu S, 2022, Quality & Quantity” is notable for its remarkable local-to-global citation ratio of 100.0, signifying that this paper has had an exceptional impact within its local research community. The normalized local citation value of 233 demonstrates its substantial local influence, while the normalized global citation value of 0.246 indicates a relatively modest global impact. The documents “Mehrotra A, 2019, International Conference on Automation, Computing, Technology and Management (ICACTM)” and “Senyo PK, 2020, International Conference on Information Systems (ICIS)” both have local-to-global citation ratios of 16.7, indicating their significance within the local research communities. The normalized local and global citation values for these papers further emphasize their relevance in the respective local and global contexts.

The remaining documents in Table 5 exhibit various local-to-global citation ratios, reflecting their diverse levels of local and global impact. For instance, “Ozili PK, 2018, Borsa Istanbul Review” has a local-to-global citation ratio of 0.3, while “Saraswati BD, 2020, Business Theory & Practice” has a ratio of 12.5. The normalized local and global citation values for these documents illustrate their relative importance within the local and global research communities.

Collaboration world map

By examining the collaboration world map, researchers can identify the key countries and partnerships that contribute significantly to the development of the research field. This understanding can help scholars recognize the existing collaborative networks, identify potential research partners, and foster future collaboration to address pressing challenges in FinTech and financial inclusion.

Figure 10 showcases the collaboration world map in the research field of Financial Technology (FinTech) and financial inclusion, emphasizing the role of digital financial services in promoting financial access and economic development. The table lists the countries involved in collaborative research efforts and the frequency of these collaborations.

Notably, China and the United States exhibit the highest frequency of collaborations, with 13 instances of joint research efforts. This finding highlights the strong research ties between these two influential countries in the FinTech and financial inclusion domain. Similarly, the United States and the United Kingdom also share a high frequency of collaborations, with 13 instances as well, indicating a robust research relationship between these two countries.

Furthermore, China and the United Kingdom have collaborated on seven research projects, while India and the United States have worked together on six projects. The United Kingdom and Australia have jointly conducted six research projects, demonstrating the strong collaborative ties between these two countries in this field.

Other noteworthy collaborations include those between Indonesia and Malaysia, the United States and Canada, and the United Kingdom and the Netherlands. These collaborations highlight the importance of international research cooperation in advancing the understanding of FinTech and financial inclusion globally.

Thematic map

Figure 11 represents thematic map analysis of the research conducted on the role of digital financial services in promoting financial access and economic development. The table lists the most frequently occurring words, their respective clusters, cluster labels, betweenness centrality, closeness centrality, and PageRank centrality.

The table is organized into two major clusters, as represented by the Cluster_Label column. Cluster 1, labeled “finance,” contains words primarily related to the financial aspects of FinTech and financial inclusion. Cluster 2, labeled “financial system,” focuses on the broader financial systems, services, and the impact of FinTech on economic development.

Betweenness centrality, closeness centrality, and PageRank centrality are network analysis metrics that help identify the most relevant and influential words within the clusters. A higher value for these centrality measures indicates a more influential and connected word in the network.

In Cluster 1, the most frequently occurring words include ‘finance’, ‘financial inclusions’, ‘electronic money’, and ‘financial service’, which have relatively high betweenness centrality, closeness centrality, and PageRank centrality values. These words signify the importance of finance and financial services in driving the FinTech and financial inclusion research. The cluster also encompasses specific concepts such as ‘mobile money’, ‘digital finance’, and ‘technology diffusion’, highlighting the critical role of technology in expanding financial access.

Cluster 2 focuses on the broader financial systems and their impact on economic development. High occurrence words include ‘financial system’, ‘financial services’, ‘banking’, and ‘economic development’. These words indicate the research’s emphasis on the interplay between FinTech, financial services, and their impact on economies. The cluster also contains words related to specific countries (e.g., ‘China’, ‘Kenya’, ‘Ghana’, ‘Nigeria’, ‘India’, ‘Indonesia’) and regions (e.g., ‘sub-Saharan Africa’), reflecting the geographical scope of the research.

From a thematic map perspective, the figure demonstrates the key topics and concepts studied in the research field of FinTech and financial inclusion. The two primary clusters emphasize the interrelationship between financial services, technology, and economic development, while also shedding light on the geographical focus of the research. The centrality measures provide insights into the most influential and connected words within the network, which can be useful in understanding the core themes and areas of focus within this research domain.

Trend topics

Figure 12 presents the trend topics in the domain of FinTech and financial inclusion, providing valuable insights into the frequency and distribution of these topics over the years, divided into quartiles (year_q1, year_med, and year_q3). The emergence of mobile communication in 2015, gaining significant attention by 2018, highlights the increasing importance of mobile connectivity in driving financial inclusion. Mobile devices play a crucial role in accessing digital financial services. Microfinance, a topic that gained prominence in 2019, demonstrates the ongoing relevance of alternative financing solutions that cater to the unbanked and underbanked populations, contributing to financial inclusion.

The growing significance of money services, such as remittances and mobile money in promoting financial access, is evident with the emergence of this topic in 2018 and its sustained relevance until 2022. Telecommunication companies’ role in enabling digital financial services is underscored by the topic of telecommunication, which surfaced in 2016. The expanding range of digital financial services and their potential to bridge the financial access gap are emphasized by the widely-discussed topic of financial services, spanning from 2018 to 2021.

The ongoing transformation of traditional banking systems and their integration with FinTech solutions to promote financial inclusion are indicated by the sustained interest in banking from 2019 to 2021. The growing importance of mobile phones as a primary tool for accessing digital financial services, particularly in developing countries, is reflected by the prevalence of this topic from 2018 to 2021. The broader implications of FinTech and financial inclusion on the global financial system are highlighted by the significant traction of the financial system topic from 2020 to 2022.

Financial inclusion’s growing recognition as a critical component of sustainable economic development is suggested by the increased attention to this topic from 2020 to 2022. The potential of FinTech and financial inclusion initiatives to address the challenges faced by developing countries in promoting financial access is underscored by the developing world topic, gaining prominence from 2018 to 2022. The widespread interest in the role of FinTech and financial inclusion in shaping the financial landscape is reflected by the broad topic of finance, which peaked in 2022.

China’s increasing influence in the FinTech and financial inclusion domains, driven by rapid adoption of digital financial services and innovative regulatory frameworks, is highlighted by the focus on China from 2021 to 2022. The interconnectedness between financial inclusion and economic development, as increased access to financial services drives growth and reduces poverty, is emphasized by the prominence of the economic development topic from 2020 to 2022. The emerging focus on Africa in 2023 reflects the growing interest in the region’s potential for leveraging FinTech to promote financial inclusion, given its large unbanked population and widespread mobile phone adoption.

Lastly, the social and economic empowerment that financial inclusion can bring to marginalized and underserved communities through digital financial services is highlighted by the emerging topic of empowerment, which surfaced in 2022 and continues to gain traction in 2023. The figure illustrates the evolving landscape of FinTech and financial inclusion research, shedding light on the critical themes and trends shaping the field.

Analysis using VOSviewer

Subsequently, the study employed VOSviewer, a cutting-edge software application tailored for creating, visualizing, and exploring bibliometric networks. VOSviewer facilitates the analysis of intricate relationships among research publications, authors, and institutions, unveiling the interconnectedness of the scholarly community. By harnessing the power of VOSviewer, the investigation reveals the dynamics of the FinTech and financial inclusion research landscape, highlighting key influencers, emerging trends, and synergies that contribute to the evolution of the field. The integration of VOSviewer’s advanced features not only enriches our comprehension of the subject matter but also enables us to identify potential avenues for future research and collaboration. It includes;

Co-authorship analysis

Institutional collaboration network analysis

The Institutional Collaboration Network Analysis unveils a core group of institutions actively collaborating and contributing to the research on FinTech and financial inclusion (Fig. 13). The leading institutions exert a considerable impact on the field through their robust collaborative networks and influential research outputs. The analysis offers valuable insights for researchers and institutions looking to establish strategic collaborations and expand their research networks within the FinTech and financial inclusion domain.

To this end, we have established specific thresholds: a minimum of one document per organization and a minimum of 30 citations. Among 1381 organizations, 162 meet these criteria. For each organization, the total strength of co-authorship links with other institutions has been calculated. A total of 164 organizations were chosen for analysis. While not all of these organizations are interconnected, the largest set of connected items consists of 18 organizations, indicating a core group of institutions actively collaborating within the FinTech and financial inclusion research domain. The Centre for Economic Policy Research (CEPR) in London, United Kingdom, and Imperial College London, United Kingdom, emerge as prominent organizations in this network, with maximum link strengths of 14 and 10, respectively. These institutions signify strong collaborative relationships within the research community.

In terms of citation count, the leading institutions are Essex Business School at the University of Essex, United Kingdom, with 364 citations; Bristol Business School at the University of the West of England, Bristol, United Kingdom, with 261 citations; and Social Policy and Social Work at the University of York, York, United Kingdom, also with 261 citations. These high citation counts demonstrate their substantial contributions to the FinTech and financial inclusion research landscape. Other organizations with notable total link strengths include the World Bank in Washington, DC, United States; African Economic Research Consortium in Nairobi, Kenya; Bocconi University in Milan, Italy; Boston College in Chestnut Hill, MA, United States; Department of Industrial Engineering at the University of Chile in Santiago, Chile; and IGIER in Milan, Italy, among others. These institutions exhibit significant collaboration patterns within the research domain.

Country network analysis

The Country Network Analysis reveals that the United Kingdom, China, and the United States are the leading countries in terms of research contributions and collaborative patterns in the FinTech and financial inclusion domain (Fig. 14). Other countries, though actively participating in the research network, have room for growth and opportunities for enhanced collaboration. This analysis offers valuable insights for researchers and institutions seeking to establish strategic partnerships and expand their research networks on a global scale within the FinTech and financial inclusion domain.

Thresholds for the analysis were set as follows: a minimum of two documents for a country and a minimum of 0 citations. Out of 105 countries, 52 met these thresholds. For each of these countries, the total strength of co-authorship links with other countries was calculated. The country with the greatest link strength was selected, resulting in a total of 52 countries. Some of these 52 items in the network are not connected to each other, with the largest set of connected items consisting of 51 items.

Based on the citation count, the United Kingdom emerges as the leading country with 2247 citations, followed by China with 1740 citations and the United States with 1546 citations. These countries have made substantial contributions to the FinTech and financial inclusion research landscape. Other notable countries in terms of citation counts include India, Australia, France, South Africa, the Netherlands, Malaysia, and Germany.

The total link strength, which represents the collaborative network among countries, also highlights the United Kingdom as the central player with 82 total link strength points. The United States follows closely with 80 points, and China occupies the third position with 43 points. This demonstrates that these countries are actively collaborating and fostering strong research relationships within the FinTech and financial inclusion domain. In addition, countries such as Malaysia, Australia, South Africa, the Netherlands, France, Germany, and India showcase varying levels of total link strength, indicating their involvement in the collaborative research network. However, their lower total link strength values in comparison to the United Kingdom, China, and the United States suggest that there is potential for expanding and strengthening research collaborations within the FinTech and financial inclusion field.

Co-occurrence investigation

The Co-occurrence Analysis reveals the primary themes, trends, and focus areas within the FinTech and financial inclusion research domain (Fig. 15). Financial inclusion, fintech, mobile money, and financial literacy emerge as central themes, while digital finance, mobile banking, and digital financial inclusion highlight the crucial role of technology in the field. The presence of blockchain and China as keywords indicates the evolving nature of the research landscape, with potential for further exploration of emerging technologies and regional perspectives.

Thresholds for the analysis were set as follows: a minimum of five occurrences for a keyword. Out of 1700 keywords, 86 met these thresholds.

Based on the number of occurrences, “financial inclusion” is the most prominent keyword with 309 occurrences, followed by “fintech” with 165 occurrences. This indicates that financial inclusion and fintech are the central themes of research within the domain. The focus on these keywords demonstrates the interest in exploring the role of FinTech in enabling financial access and promoting economic development.

“Mobile money” is another significant keyword with 107 occurrences, reflecting the growing importance of mobile-based financial services in expanding financial inclusion. The keyword “financial literacy” occurs 59 times, highlighting the role of financial education in enhancing the effective use of FinTech services and promoting financial inclusion. Other important keywords include “digital finance” (48 occurrences), “financial technology” (46 occurrences), and “mobile banking” (40 occurrences), emphasizing the relevance of digital solutions in transforming the financial services landscape. “Digital financial inclusion” (32 occurrences) further underscores the focus on leveraging digital technology to promote inclusive finance.

“Blockchain” (22 occurrences) and “China” (22 occurrences) also feature as notable keywords. The emergence of blockchain as a keyword indicates the increasing interest in exploring its potential applications in the FinTech and financial inclusion space. China’s presence as a keyword reflects the country’s significant role in driving FinTech innovations and shaping the global discourse on financial inclusion.

Bibliographic coupling insights

Document interconnectedness analysis

The document interconnectedness analysis offers insights into the influential papers in the FinTech and financial inclusion research domain, as well as the relationships between these papers based on shared citations (Fig. 16). The high citation count and total link strength of some documents highlight their importance within the field, while others show relatively lower interconnectedness despite a high citation count. This analysis can guide researchers in identifying key literature and understanding the thematic relationships within the domain.

Thresholds for the analysis were set as follows: a minimum of 30 citations for a document. Out of 698 documents, 69 met these thresholds. The total strength of bibliographic links with other documents was calculated for each of the 69 documents, and the documents with the largest number of links were selected.

The document by Ozili P.K. (2018) emerges as the most influential paper in the field, with 364 citations and a total link strength of 9. Gabor D. and Brooks S. (2017) have the second most cited paper with 261 citations and a total link strength of 6. Zins and Weill (2016) have the third most cited paper with 207 citations, but it has a total link strength of 0, suggesting a relatively lower interconnectedness with other influential papers in the field. Some documents display a high total link strength, indicating strong interconnectedness with other influential papers. For example, Koomson et al. (2020) have a total link strength of 29, the highest among the selected documents, despite having a moderate citation count of 94. Demir et al. (2022) have a total link strength of 30 with 75 citations, suggesting a high degree of interconnectedness in the field.

Source Nexus Exploration

This Source Nexus Exploration provides valuable insights into the influential sources in the research domain of financial technology and financial inclusion (Fig. 17). It helps researchers understand the most interconnected sources, which can be crucial for identifying important literature and understanding the relationships between sources within the domain. A high total link strength suggests that a source has significant relationships with other sources, which can be valuable for researchers when exploring the research landscape of financial technology and financial inclusion.

In this bibliometric analysis, the VOSviewer tool has been used to explore the source nexus within the research domain of financial technology and financial inclusion. By examining the bibliographic coupling links between sources, we aim to identify the most influential and interconnected sources in the field.

Thresholds for the analysis were set as follows: a minimum of three documents for a source and a minimum of 10 citations for a source. Out of 370 sources, 46 met these thresholds. For each of the 46 sources, the total strength of bibliographic coupling links with other sources was calculated. The sources with the largest number of links were selected.

The source with the highest number of citations is Sustainability (Switzerland), with 480 citations and a total link strength of 245. Borsa Istanbul Review follows with 368 citations and a total link strength of 154. New Political Economy ranks third with 351 citations and a total link strength of 64. However, Telecommunications Policy has the highest total link strength of 479, despite having fewer citations (236) than the top three sources. World Development is another important source, with 256 citations and a high total link strength of 284. The International Journal of Social Economics has a notably high total link strength of 464 with 70 citations, indicating strong interconnectedness with other sources.

Authors network analysis

This authors network analysis provides valuable insights into the influential authors in the research domain of financial technology and financial inclusion (Fig. 18). It helps researchers understand the most interconnected authors, which can be crucial for identifying key literature and understanding the relationships between authors within the domain. A high total link strength suggests that an author has significant relationships with other authors, which can be valuable for researchers when exploring the research landscape of financial technology and financial inclusion.

Thresholds for the analysis were set as follows: a minimum of one document for an author and a minimum of 31 citations for an author. Out of 676 authors, 70 met these thresholds. For each of the 70 authors, the total strength of bibliographic coupling links with other authors was calculated. Some of the 70 items in the network are not connected to each other. The largest set of connected items consists of 56 items.

Ozili P.K. leads with the highest number of citations (439) and a total link strength of 64, indicating a strong influence in the field. Gabor D. and Brooks S. follow with a combined 261 citations and a total link strength of 8. Zins A. and Weill L. are third in terms of citations (207), but their total link strength is 0, suggesting a lesser interconnectedness with other authors. Munyegera G.K. and Matsumoto T. have a notable total link strength of 24 with 205 citations. Lashitew A.A., Van Tulder R., and Liasse Y. have a combined 103 citations and a significant total link strength of 32. Demir A., Pesqué-Cela V., Altunbas Y., and Murinde V. have a combined 75 citations and an even higher total link strength of 37. Bernards N. stands out with a comparatively high total link strength of 49 despite having fewer citations (65) than some of the other authors. This indicates strong interconnectedness with other authors in the field.

Organisational research confluence

The given information presents a co-occurrence analysis of organizations within the field of Financial Technology and Financial Inclusion, specifically focusing on bibliographic coupling using the VOSviewer tool (Fig. 19). The thresholds chosen for the analysis are a minimum of 1 document per organization and a minimum of 50 citations per organization. Out of the 1381 organizations, 106 meet these thresholds.

The total link strength of the bibliographic coupling links between these organizations is calculated, and the organization with the largest number of links is selected. Out of the 106 organizations, not all are connected with each other, and the largest set of connected items is made up of 86 items.

The Bibliographic Coupling- Organisational Research Confluence indicates a diverse range of organizations from different countries, showcasing the global scope of the research field. These organizations include universities, research institutes, and international organizations such as the World Bank. Some organizations have a strong presence in the field, demonstrated by their high citation numbers and total link strength. For example, CEPR (Centre for Economic Policy Research) in London has a total of 186 citations and a total link strength of 510. Similarly, Imperial College London has 142 citations and a total link strength of 298. These figures suggest that these organizations play a significant role in the field and contribute to the development of knowledge in Financial Technology and Financial Inclusion. Furthermore, the analysis reveals several organizations with strong connections to others in the field, such as Bristol Business School (University of the West of England) and the Social Policy and Social Work department at the University of York, both having 261 citations and a total link strength of 71.

The co-occurrence analysis also highlights collaborations between organizations from different regions, fostering international exchange of ideas and knowledge. For instance, the African Economic Research Consortium in Nairobi, Kenya, has 118 citations and a total link strength of 238, indicating its active collaboration with other organizations in the field. The Bibliographic Coupling—Organisational Research Confluence provides valuable insights into the relationships and collaborations between organizations in the field of Financial Technology and Financial Inclusion. It highlights the global nature of the research field, the key players in terms of citation numbers and link strength, and the importance of international collaboration in advancing knowledge and understanding within the field.

Country network analysis

The bibliographic coupling-country network analysis offers valuable insights into the interconnectedness among countries in the fields of Financial Technology and Financial Inclusion (Fig. 20). Utilizing the VOSviewer tool for bibliometric analysis, it becomes possible to analyze and interpret the co-occurrence relationships based on the provided data. By setting the thresholds for the minimum number of documents of a country to 2 and the minimum number of citations of a country to 0, 73 out of 105 countries meet these criteria. The total strength of the bibliographic coupling links with other countries is calculated for each of these 73 countries. Notably, out of the 73 countries in the network, some are not connected to each other, with the largest set of connected items comprising 72 countries.

A close examination of the data reveals several key findings. Firstly, the United Kingdom, China, and the United States emerge as the top three countries with the highest number of citations, indicating their significant role in Financial Technology and Financial Inclusion research. They also boast the highest total link strengths, signifying a strong interconnectedness with other countries in the network. Secondly, emerging economies like India, South Africa, Nigeria, and Ghana display a considerable number of citations and total link strengths, highlighting the increasing importance of Financial Inclusion and Financial Technology in these regions.

Furthermore, the presence of countries from diverse geographical regions such as Malaysia, Australia, France, and the Netherlands demonstrates the global nature of research collaboration in Financial Technology and Financial Inclusion. In some cases, countries with fewer citations, like Lebanon, Finland, and Hungary, exhibit relatively high total link strengths. This implies that these countries are well-connected within the research network, even though they might have fewer publications. Conversely, countries such as New Zealand, Denmark, and Greece have a higher number of citations but relatively lower total link strengths, indicating that their research output might be more self-contained or focused on a few specific collaboration partners.

The Bibliographic Coupling-Country Network Analysis sheds light on the global landscape of Financial Technology and Financial Inclusion research. The data reveals a diverse and interconnected network of countries, with varying degrees of collaboration and research output. This information can serve as a valuable resource for researchers, policymakers, and stakeholders interested in understanding the dynamics of research collaboration in these fields.

Co-citation

Cited references analysis

The co-citation-cited references analysis allows for a deeper understanding of the connections and relationships between the most frequently cited references in the Financial Technology and Financial Inclusion research fields (Fig. 21). Utilizing the VOSviewer tool for bibliometric analysis, it is possible to analyze and interpret the co-citation relationships based on the given data. By setting the threshold for the minimum number of citations of cited references to 5227 out of 33,127 cited references meet the criteria. For each of the 227 cited references, the total strength of the co-citation links with other cited references is calculated.

A closer examination of the data reveals several key insights. Demirguc-Kunt et al.‘s work, “The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution” (2018), emerges as the most frequently cited reference, with 64 citations and a total link strength of 306. This suggests that their research has made a significant impact on the field, shaping the discourse on financial inclusion and fintech. Another influential work is Suri and Jack’s “The Long-Run Poverty and Gender Impacts of Mobile Money” (2016), which has 52 citations and a total link strength of 337, indicating the importance of mobile money in the broader discussion of financial inclusion.

Furthermore, Ozili’s “Impact of Digital Finance on Financial Inclusion and Stability” (2018), Gabor and Brooks’s “The Digital Revolution in Financial Inclusion: International Development in the Fintech Era” (2017), and Zins and Weill’s “The Determinants of Financial Inclusion in Africa” (2016) are among the most frequently cited works, demonstrating the diverse range of topics and issues explored in this research field.

The presence of publications focusing on specific countries or regions, such as Munyegera and Matsumoto’s “Mobile Money, Remittances, and Household Welfare: Panel Evidence from Rural Uganda” (2016) and Fungacova and Weill’s “Understanding Financial Inclusion in China” (2015), highlights the relevance of localized case studies in understanding the broader landscape of financial inclusion and fintech.

Cited authors mapping

The co-citation cited authors mapping analysis aims to identify the most influential authors in the field of Financial Technology and Financial Inclusion based on their citations and the total link strength with other authors (Fig. 22). The threshold for this analysis was set at a minimum of 30 citations, resulting in a list of 181 authors out of 33,690 sources.

The analysis shows that Demirguc-Kunt A. holds the highest number of citations (628) and total link strength (18,167), indicating that this author’s work is highly influential and relevant in the domain of Financial Technology and Financial Inclusion. Other notable authors include Klapper L. (496 citations, 14,830 total link strength), Beck T. (272 citations, 8087 total link strength), Suri T. (266 citations, 8065 total link strength), and Singer D. (262 citations, 7969 total link strength). The high total link strength of these authors suggests that their work is frequently co-cited with other influential works, revealing that their research is interconnected within the field. It also implies that their research findings are broadly accepted, and they have made a significant impact on the understanding and development of Financial Technology and Financial Inclusion.

Discussion

The research trajectory on the role of digital financial services in fostering financial access and economic development reflects a growing interest in this area, particularly since 2016. This surge underscores the potential of FinTech in strengthening financial inclusion and its relevance in the context of sustainable development. Financial inclusion has become increasingly important as a means to alleviate poverty, reduce income inequality, and promote economic growth (Demirguc-Kunt et al., 2015). The rise of digital financial services, driven by advancements in technology, offers innovative solutions to address the financial needs of unbanked and underbanked populations (Mendoza et al., 2019).

Analyzing the average citations per year for research output on digital financial services’ role in advancing financial access and economic development, it is observed that early publications (2010–2012) have a higher citation impact. This may be attributed to the novelty of the research topic and the limited number of competing publications at that time. In contrast, more recent publications (2019–2023) show a declining citation impact, which is expected to change as these articles gain further academic attention. The early influential publications laid the foundation for subsequent studies and informed the development of new concepts and methodologies in the field (Bazgha, 2016).

The interdisciplinary nature of the subject matter is evident from the diverse disciplines contributing to the examination of digital financial services’ impact on financial access and economic development. These include economics, finance, technology forecasting, social change, telecommunications policy, enterprise development, microfinance, and development studies. This highlights the growing significance of FinTech and financial inclusion across various academic domains and signifies the complex interplay between technology, society, and financial systems. A surge in research production between 2020 and 2022 emphasizes the growing significance of FinTech and financial inclusion, with the top six most relevant sources’ production over time reflecting this trend. The increased attention on this subject could be attributed to the expanding role of digital financial services in addressing the challenges faced by traditional financial institutions, as well as the ongoing digital transformation in the global economy.