The Bank of England has worked closely with researchers to better understand systemic risks to the banking system.Credit: Jason Alden/Bloomberg/Getty

The past six weeks have witnessed a mini-crisis for banks in the United States and Europe. Several US banks failed within a matter of days, most notably Silicon Valley Bank, which collapsed on 10 March after depositors rushed to withdraw a jaw-dropping US$42 billion in the space of a single day. Days later, the Swiss bank UBS merged with former competitor Credit Suisse after the latter’s failure.

Researchers are not ruling out further closures or other effects. And they’re warning governments not to loosen regulations that were put in place after more than 400 banks collapsed in the United States alone in the wake of the global financial crisis of 2007–08. These warnings are based on work forged through long-standing links between researchers and central bankers — and should be heeded1.

Rapid interest-rate rises are a key reason why some banks are now vulnerable. Rates have been relatively low for several decades, and this has coincided with high levels of borrowing, especially by governments2. Many central banks have now put up interest rates in an effort to tame rising inflation. This is causing problems for banks, because many assets that banks already held as loans are now worth less than are loans of the same value made at today’s rates. Silicon Valley Bank sold some of its loans at a loss and tried to raise capital. This, fuelled by frenetic social-media commentary, caused a run on the bank3.

What the Silicon Valley Bank collapse means for science start-ups

So far, however, we’re not seeing contagion — the failures have been relatively isolated. One reason for this is that central banks and regulatory agencies have a much better understanding of the banking system as a whole than they did in 2008. Another is that governments have implemented stricter rules, meaning that individual banks are better able to withstand shocks. Research has been key to these developments, with a number of influential studies emerging as a result of contacts made between scientists and central bankers in the early years of this century.

In 2006, the Federal Reserve Bank of New York and the US National Academies of Sciences, Engineering, and Medicine organized a conference to bring these two groups together in the spirit of problem-solving. This caught the attention of the mathematical ecologist Robert May, a former chief scientific adviser to the UK government who had become a legislator in the House of Lords. May and his colleagues wrote about the conference in a Nature News & Views article called ‘Ecology for bankers’4 and started to collaborate with researchers studying finance, and with the United Kingdom’s central bank, the Bank of England.

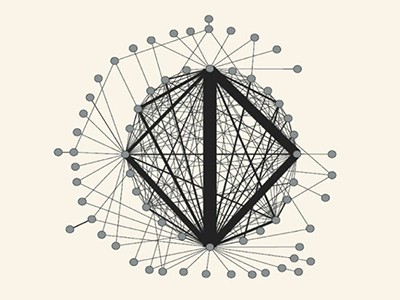

In 2011, May co-authored a study with Andrew Haldane, formerly chief economist at the Bank of England, that helped the authorities to get a better grip on systemic risks5. Using insights from the study of diversity and stability in ecosystems, coupled with techniques used in infectious-disease epidemiology, May and Haldane showed that the stability of the banking system is tied not to the health of any one bank, but to the collective stability of many institutions that interact closely. They adopted the term ‘super-spreader’ for a large bank that is connected to many smaller banks and whose failure therefore creates instability throughout the banking system.

Another piece of research, published in 2012 by Stefano Battiston, who studies financial networks at the University of Zurich in Switzerland, and his colleagues6 was among those that enabled regulators to improve how they monitor individual banks. The team devised a measure called DebtRank. Inspired by Google’s PageRank algorithm, this uses data on banks’ assets and liabilities to calculate an index that reflects the risks to the financial system should a particular bank fail.

These and other studies helped to establish the evidence for a set of regulations, drafted after the 2007–08 crisis, known as Basel III. The regulations specify that large banks in many countries need to hold higher amounts of capital and liquidity than before, to reduce the risk of failure from bank runs. A number of countries have since set up agencies that watch the whole banking system closely, and big banks regularly undergo ‘stress testing’ to evaluate their probable performance in the event of a bank run or a financial or economic crisis. The rules also discourage commercial banks from making high-risk investments.

But in 2018, then US president Donald Trump weakened the US rules, which were first set out in the Dodd–Frank Act of 2010. Now, both the European Union and the UK government are considering doing something similar. The UK government, for example, plans to change the law so that regulators are required to focus not only on maintaining stability, but also on growth and competitiveness. The implication is that some extra risks can be taken to boost flagging economies. Haldane tells Nature that this year’s mini-crisis stands as the counterpoint to such reasoning.

There is perhaps no way to stabilize the financial system once and for all, no set of rules or means of oversight that can provide permanent safety. But the recent mini-crisis underscores the necessity of vigilance, backed by strong relationships between central bankers and the research community. These relationships have undoubtedly helped to strengthen regulatory oversight over the past 15 years. That, in turn, has allowed regulators to monitor the banking ecosystem — and act quickly when the need arises.

What the Silicon Valley Bank collapse means for science start-ups

What the Silicon Valley Bank collapse means for science start-ups

Systemic risk in banking ecosystems

Systemic risk in banking ecosystems

DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk

DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk

The physics of financial networks

The physics of financial networks

Ecology for bankers

Ecology for bankers