Abstract

Quantum computers are expected to surpass the computational capabilities of classical computers and have a transformative impact on numerous industry sectors. We present a comprehensive summary of the state of the art of quantum computing for financial applications, with particular emphasis on stochastic modelling, optimization and machine learning. This Review is aimed at physicists, so it outlines the classical techniques used by the financial industry and discusses the potential advantages and limitations of quantum techniques. Finally, we look at the challenges that physicists could help tackle.

Key points

-

Quantum algorithms for stochastic modelling, optimization and machine learning are applicable to various financial problems.

-

Quantum Monte Carlo integration and gradient estimation can provide quadratic speedup over classical methods, but more work is required to reduce the amount of quantum resources for early fault-tolerant feasibility and achieving an actual speedup.

-

Financial optimization problems can be continuous (convex or non-convex), discrete or mixed, and thus quantum algorithms for these problems can be applied.

-

The advantages and challenges of quantum machine learning for classical problems are also apparent in finance.

This is a preview of subscription content, access via your institution

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

$29.99 / 30 days

cancel any time

Subscribe to this journal

Receive 12 digital issues and online access to articles

$99.00 per year

only $8.25 per issue

Buy this article

- Purchase on Springer Link

- Instant access to full article PDF

Prices may be subject to local taxes which are calculated during checkout

Similar content being viewed by others

References

Shreve, S. E. Stochastic Calculus for Finance I (Springer New York, 2004).

Alexeev, Y. et al. Quantum computer systems for scientific discovery. PRX Quantum 2, 017001 (2021).

Glasserman, P. Monte Carlo Methods in Financial Engineering, Vol. 53 (Springer, 2004).

Egger, D. J. et al. Quantum computing for finance: state-of-the-art and future prospects. IEEE Trans. Quantum Eng. 1, 3101724 (2020).

Orus, R., Mugel, S. & Lizaso, E. Quantum computing for finance: overview and prospects. Rev. Phys. 4, 100028 (2019).

Bouland, A., van Dam, W., Joorati, H., Kerenidis, I. & Prakash, A. Prospects and challenges of quantum finance. Preprint at https://doi.org/arXiv:2011.06492 (2020).

Pistoia, M. et al. Quantum machine learning for finance. In IEEE/ACM International Conference on Computer Aided Design (ICCAD) (IEEE/ACM, 2021).

Gómez, A. et al. A survey on quantum computational finance for derivatives pricing and VaR. in Archives of Computational Methods in Engineering 1–27 (Springer, 2022).

Griffin, P. & Sampat, R. Quantum computing for supply chain finance. In 2021 IEEE International Conference on Services Computing (SCC) 456–459 (IEEE, 2021).

Ganapathy, A. Quantum computing in high frequency trading and fraud detection. Eng. Int. 9, 61–72 (2021).

Wang, M., Pan, Y., Yang, X., Li, G. & Xu, Z. Tensor networks meet neural networks: a survey. Preprint at https://doi.org/arXiv:2302.09019 (2023).

Sengupta, R., Adhikary, S., Oseledets, I. & Biamonte, J. Tensor networks in machine learning. Preprint at https://doi.org/arXiv:2207.02851 (2022).

Patel, R. G. et al. Quantum-inspired tensor neural networks for option pricing. Preprint at https://doi.org/arXiv:2212.14076 (2022).

Nielsen, M. A. & Chuang, I. L. Quantum Computation and Quantum Information (Cambridge Univ. Press, 2010).

Kitaev, A. Y., Shen, A. H. & Vyalyi, M. N. Classical and Quantum Computation (American Mathematical Society, 2002).

Hull, J. C. Options Futures and Other Derivatives 11th edn (Pearson, 2021).

Wilmott, P. Paul Wilmott on Quantitative Finance 2nd edn (John Wiley & Sons, 2013).

Föllmer, H. & Schied, A. Stochastic Finance: An Introduction in Discrete Time (Walter de Gruyter, 2011).

Black, F. & Scholes, M. The pricing of options and corporate liabilities. In World Scientific Reference on Contingent Claims Analysis in Corporate Finance: Vol. 1: Foundations of CCA and Equity Valuation 3–21 (World Scientific, 2019).

Tse, W. M. Closed-form Solutions for Fixed-strike Arithmetic Asian Options (SSRN, 2018); https://dx.doi.org/10.2139/ssrn.3176932.

Kac, M. On distributions of certain Wiener functionals. Trans. Am. Math. Soc. 65, 1–13 (1949).

Feynman, R. P. The principle of least action in quantum mechanics. In Feynman’s Thesis — A New Approach to Quantum Theory 1–69 (World Scientific, 2005).

Heinrich, S. Quantum summation with an application to integration. J. Complex 18, 1–50 (2002).

Brassard, G., Dupuis, F., Gambs, S. & Tapp, A. An optimal quantum algorithm to approximate the mean and its application for approximating the median of a set of points over an arbitrary distance. Preprint at https://doi.org/arXiv:1106.4267 (2011).

Montanaro, A. Quantum speedup of Monte Carlo methods. Proc. R. Soc. A Math. Phys. Eng. Sci. 471, 20150301 (2015).

Cornelissen, A. & Jerbi, S. Quantum algorithms for multivariate Monte Carlo estimation. Preprint at https://doi.org/arXiv:2107.03410 (2021).

Kothari, R. & O’Donnell, R. Mean estimation when you have the source code; or, quantum Monte Carlo methods. Preprint at https://doi.org/arXiv:2208.07544 (2022).

Babbush, R. et al. Focus beyond quadratic speedups for error-corrected quantum advantage. PRX Quantum 2 010103 (2021).

Huang, H.-Y., Bharti, K. & Rebentrost, P. Near-term quantum algorithms for linear systems of equations with regression loss functions. New J. Phys. 23, 113021 (2021).

Suzuki, Y. et al. Amplitude estimation without phase estimation. Quantum Inf. Process. 19, 1–17 (2020).

Grinko, D., Gacon, J., Zoufal, C. & Woerner, S. Iterative quantum amplitude estimation. npj Quantum Inf. 7, 52 (2021).

Giurgica-Tiron, T., Kerenidis, I., Labib, F., Prakash, A. & Zeng, W. Low depth algorithms for quantum amplitude estimation. Quantum 6, 745 (2022).

Grover, L. & Rudolph, T. Creating superpositions that correspond to efficiently integrable probability distributions. Preprint at https://doi.org/quant-ph/0208112 (2002).

Marin-Sanchez, G., Gonzalez-Conde, J. & Sanz, M. Quantum algorithms for approximate function loading. Preprint at https://doi.org/2111.07933 (2021).

Herbert, S. No quantum speedup with Grover–Rudolph state preparation for quantum Monte Carlo integration. Phys. Rev. E 103, 063302 (2021).

Grover, L. K. Synthesis of quantum superpositions by quantum computation. Phys. Rev. Lett. 85, 1334–1337 (2000).

Sanders, Y. R., Low, G. H., Scherer, A. & Berry, D. W. Black-box quantum state preparation without arithmetic. Phys. Rev. Lett. 122, 020502 (2019).

Wang, S. et al. Fast black-box quantum state preparation based on linear combination of unitaries. Quantum Inf. Process. 20, 270 (2021).

Wang, S. et al. Inverse-coefficient black-box quantum state preparation. New J. Phys. 24, 103004 (2022).

Bausch, J. Fast black-box quantum state preparation. Quantum 6, 773 (2022).

McArdle, S., Gilyén, A. & Berta, M. Quantum state preparation without coherent arithmetic. Preprint at https://doi.org/arXiv:2210.14892 (2022).

Cerezo, M. et al. Variational quantum algorithms. Nat. Rev. Phys. 3, 625–644 (2021).

Zoufal, C., Lucchi, A. & Woerner, S. Quantum generative adversarial networks for learning and loading random distributions. npj Quantum Inf. 5, 103 (2019).

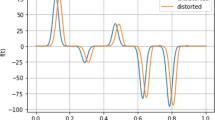

Nakaji, K. et al. Approximate amplitude encoding in shallow parameterized quantum circuits and its application to financial market indicators. Phys. Rev. Res. 4, 023136 (2022).

Rattew, A. G., Sun, Y., Minssen, P. & Pistoia, M. The efficient preparation of normal distributions in quantum registers. Quantum 5, 609 (2021).

Rattew, A. G. & Koczor, B. Preparing arbitrary continuous functions in quantum registers with logarithmic complexity. Preprint at https://doi.org/arXiv:2205.00519 (2022).

Zhang, X.-M., Yung, M.-H. & Yuan, X. Low-depth quantum state preparation. Phys. Rev. Res. 3, 043200 (2021).

Möttönen, M., Vartiainen, J. J., Bergholm, V. & Salomaa, M. M. Transformation of quantum states using uniformly controlled rotations. Quantum Info. Comput. 5, 467–473 (2005).

Araujo, I. F., Park, D. K., Petruccione, F. & da Silva, A. J. A divide-and-conquer algorithm for quantum state preparation. Sci. Rep. 11, 6329 (2021).

Chakrabarti, S. et al. A threshold for quantum advantage in derivative pricing. Quantum 5, 463 (2021).

Dupire, B. Pricing with a smile. Risk 7, 18–20 (1994).

Duffie, D. & Glynn, P. Efficient Monte Carlo simulation of security prices. Ann. Appl. Probab. 5, 897–905 (1995).

Giles, M. B. Multilevel Monte Carlo path simulation. Oper. Res. 56, 607–617 (2008).

An, D. et al. Quantum-accelerated multilevel Monte Carlo methods for stochastic differential equations in mathematical finance. Quantum 5, 481 (2021).

Ramos-Calderer, S. et al. Quantum unary approach to option pricing. Phys. Rev. A 103, 032414 (2021).

Stamatopoulos, N. et al. Option pricing using quantum computers. Quantum 4, 291 (2020).

Longstaff, F. A. & Schwartz, E. S. Valuing American options by simulation: a simple least-squares approach. Rev. Financ. Stud. 14, 113–147 (2001).

Doriguello, J. A. F., Luongo, A., Bao, J., Rebentrost, P. & Santha, M. Quantum algorithm for stochastic optimal stopping problems with applications in finance. In 17th Conference on the Theory of Quantum Computation, Communication and Cryptography (TQC 2022), Vol. 232 of Leibniz International Proceedings in Informatics (LIPIs) (eds Le Gall, F. & Morimae, T.) 2:1–2:24 (Schloss Dagstuhl — Leibniz-Zentrum für Informatik, 2022); https://drops.dagstuhl.de/opus/volltexte/2022/16509.

Gilyén, A., Su, Y., Low, G. H. & Wiebe, N. Quantum singular value transformation and beyond: exponential improvements for quantum matrix arithmetics. In Proceedings of the 51st Annual ACM SIGACT Symposium on Theory of Computing (ACM, 2019).

Stamatopoulos, N., Mazzola, G., Woerner, S. & Zeng, W. J. Towards quantum advantage in financial market risk using quantum gradient algorithms. Quantum 6, 770 (2022).

Capriotti, L. Fast Greeks by Algorithmic Differentiation (SSRN, 2010); https://dx.doi.org/10.2139/ssrn.1619626.

Giles, M. & Glasserman, P. Smoking adjoints: fast Monte Carlo greeks. Risk 19, 88–92 (2006).

Huge, B. & Savine, A. Differential machine learning. Preprint at https://doi.org/arXiv:2005.02347 (2020).

Wierichs, D., Izaac, J., Wang, C. & Lin, C. Y.-Y. General parameter-shift rules for quantum gradients. Quantum 6, 677 (2022).

Woerner, S. & Egger, D. J. Quantum risk analysis. npj Quantum Inf. 5, 15 (2019).

Egger, D. J., Gutierrez, R. G., Mestre, J. & Woerner, S. Credit risk analysis using quantum computers. IEEE Trans. Comput. 70, 2136–2145 (2021).

Grossmann, C., Roos, H.-G. & Stynes, M. Numerical Treatment of Partial Differential Equations Vol. 154 (Springer, 2007).

Miyamoto, K. & Kubo, K. Pricing multi-asset derivatives by finite-difference method on a quantum computer. IEEE Trans. Quantum Eng. 3, 3100225 (2022).

Broadie, M., Glasserman, P. & Kou, S. A continuity correction for discrete barrier options. Math. Financ. 7, 325–349 (1997).

Linden, N., Montanaro, A. & Shao, C. Quantum vs. classical algorithms for solving the heat equation. In Communications in Mathematical Physics 1–41 (Springer, 2022).

Gonzalez-Conde, J., Rodríguez-Rozas, A., Solano, E. & Sanz, M. Simulating option price dynamics with exponential quantum speedup. Preprint at https://doi.org/arXiv:2101.04023 (2021).

Jin, S. & Liu, N. Quantum algorithms for computing observables of nonlinear partial differential equations. Preprint at https://doi.org/arXiv:2202.07834 (2022).

Jin, S., Liu, N. & Yu, Y. Quantum simulation of partial differential equations via schrodingerisation. Preprint at https://doi.org/arXiv:2212.13969 (2022).

Jin, S., Liu, N. & Yu, Y. Quantum simulation of partial differential equations via schrodingerisation: technical details. Preprint at https://doi.org/arXiv:2212.14703 (2022).

Fontanela, F., Jacquier, A. & Oumgari, M. A quantum algorithm for linear PDEs arising in finance. SIAM J. Financ. Math. 12, SC98–SC114 (2021).

Alghassi, H. et al. A variational quantum algorithm for the Feynman–Kac formula. Quantum 6, 730 (2022).

Kubo, K., Nakagawa, Y. O., Endo, S. & Nagayama, S. Variational quantum simulations of stochastic differential equations. Phys. Rev. A 103, 052425 (2021).

Boyle, P. P. Option valuation using a three jump process. Int. Opt. J. 3, 7–12 (1986).

Kyriienko, O., Paine, A. E. & Elfving, V. E. Solving nonlinear differential equations with differentiable quantum circuits. Phys. Rev. A 103, 052416 (2021).

Schuld, M. & Petruccione, F. In Quantum Models as Kernel Methods 217–245 (Springer International Publishing, 2021); https://doi.org/10.1007/978-3-030-83098-4_6

Jerbi, S. et al. Quantum machine learning beyond kernel methods. Preprint at https://doi.org/arXiv:2110.13162 (2021).

Nesterov, Y. Introductory lectures on convex programming volume I: basic course. Lect. Notes 3, 5 (1998).

Nemirovski, A. Lectures on modern convex optimization. In Society for Industrial and Applied Mathematics (SIAM (Citeseer), 2001).

Panik, M. J. Fundamentals of Convex Analysis (Springer, 1993).

Cornuéjols, G., Peña, J. & Tütüncü, R. Optimization Methods in Finance 2nd edn (Cambridge Univ. Press, 2018).

Markowitz, H. Portfolio selection. J. Finance 7, 77–91 (1952).

Chakraborty, S., Gilyén, A. & Jeffery, S. The power of block-encoded matrix powers: improved regression techniques via faster hamiltonian simulation. In International Colloquium on Automata, Languages and Programming (ICALP, 2019).

Arora, S. & Kale, S. A combinatorial, primal-dual approach to semidefinite programs. J. ACM 63, 12 (2016).

van Apeldoorn, J., Gilyén, A., Gribling, S. & de Wolf, R. Quantum SDP-solvers: better upper and lower bounds. Quantum 4, 230 (2020).

van Apeldoorn, J. & Gilyén, A. Improvements in quantum SDP-solving with applications. In ICALP (Schloss Dagstuhl - Leibniz-Zentrum fuer Informatik, 2019).

Arora, S., Hazan, E. & Kale, S. The multiplicative weights update method: a meta-algorithm and applications. Theory Comput. 8, 121–164 (2012).

Hazan, E. & Kale, S. An online portfolio selection algorithm with regret logarithmic in price variation. Math. Financ. 25, 288–310 (2015).

Hazan, E. et al. Introduction to online convex optimization. Found. Trends Optim. 2, 157–325 (2016).

Lim, D. & Rebentrost, P. A quantum online portfolio optimization algorithm. Preprint at https://doi.org/arXiv:2208.14749 (2022).

Grigoriadis, M. D. & Khachiyan, L. G. A sublinear-time randomized approximation algorithm for matrix games. Oper. Res. Lett. 18, 53–58 (1995).

van Apeldoorn, J. & Gilyén, A. Quantum algorithms for zero-sum games. Preprint at https://doi.org/arXiv:1904.03180 (2019).

Bouland, A., Getachew, Y., Jin, Y., Sidford, A. & Tian, K. Quantum speedups for zero-sum games via improved dynamic Gibbs sampling. Preprint at https://doi.org/arXiv:2301.03763 (2023).

Rebentrost, P., Luongo, A., Bosch, S. & Lloyd, S. Quantum computational finance: martingale asset pricing for incomplete markets. Preprint at https://doi.org/arXiv:2209.08867 (2022).

Li, T., Wang, C., Chakrabarti, S. & Wu, X. Sublinear classical and quantum algorithms for general matrix games. In Proceedings of the AAAI Conference on Artificial Intelligence, Vol. 35, 8465–8473 (AAAI, 2021).

Shalev-Shwartz, S. et al. Online learning and online convex optimization. Found. Trends Machine Learn. 4, 107–194 (2012).

Li, T., Chakrabarti, S. & Wu, X. Sublinear quantum algorithms for training linear and kernel-based classifiers. In International Conference on Machine Learning 3815–3824 (PMLR, 2019).

Lee, Y. T., Sidford, A. & Wong, S. C.-W. A faster cutting plane method and its implications for combinatorial and convex optimization. In 2015 IEEE 56th Annual Symposium on Foundations of Computer Science 1049–1065 (IEEE, 2015).

Cohen, M. B., Lee, Y. T. & Song, Z. Solving linear programs in the current matrix multiplication time. J. ACM https://doi.org/10.1145/3424305 (2021).

Monteiro, R. & Tsuchiya, T. Polynomial convergence of primal-dual algorithms for the second-order cone program based on the MZ-family of directions. Math. Program. 88, 61–83 (2000).

Kerenidis, I. & Prakash, A. A quantum interior point method for LPs and SDPs. ACM Trans. Quantum Comput. 1, 5 (2020).

Kerenidis, I., Prakash, A. & Szilágyi, D. Quantum algorithms for second-order cone programming and support vector machines. Quantum 5, 427 (2021).

Augustino, B., Nannicini, G., Terlaky, T. & Zuluaga, L. F. Quantum interior point methods for semidefinite optimization. Preprint at https://doi.org/arXiv:2112.06025 (2021).

Dalzell, A. M. et al. End-to-end resource analysis for quantum interior point methods and portfolio optimization. Preprint at https://doi.org/arXiv:2211.12489 (2022).

Nannicini, G. Fast quantum subroutines for the simplex method. in Integer Programming and Combinatorial Optimization (eds Singh, M. & Williamson, D. P.) 311–325 (Springer International Publishing, 2021).

Rebentrost, P. & Lloyd, S. Quantum computational finance: quantum algorithm for portfolio optimization. Preprint at https://doi.org/arXiv:1811.03975 (2018).

Yalovetzky, R., Minssen, P., Herman, D. & Pistoia, M. NISQ-HHL: portfolio optimization for near-term quantum hardware. Preprint at https://doi.org/arXiv:2110.15958 (2021).

Moehle, N., Kochenderfer, M. J., Boyd, S. & Ang, A. Tax-aware portfolio construction via convex optimization. J. Optim. Theory Appl. 189, 364–383 (2021).

Bertsimas, D. & Cory-Wright, R. A scalable algorithm for sparse portfolio selection. INFORMS J. Comput. 34, 1305–1840 (2022).

Liu, Y., Su, W. J. & Li, T. On quantum speedups for nonconvex optimization via quantum tunneling walks. Preprint at https://doi.org/arXiv:2209.14501 (2022).

Leng, J., Hickman, E., Li, J. & Wu, X. Quantum hamiltonian descent. Preprint at https://doi.org/arXiv:2303.01471 (2023).

Wolsey, L. A. & Nemhauser, G. L. Integer and Combinatorial Optimization, Vol. 55 (John Wiley & Sons, 1999).

Morrison, D. R., Jacobson, S. H., Sauppe, J. J. & Sewell, E. C. Branch-and-bound algorithms: a survey of recent advances in searching, branching, and pruning. Discrete Optim. 19, 79–102 (2016).

Apers, S., Gily’en, A. & Jeffery, S. A unified framework of quantum walk search. In Symposium on Theoretical Aspects of Computer Science (Dagstuhl Publishing, 2021).

Apers, S. & Sarlette, A. Quantum fast-forwarding: Markov chains and graph property testing. Preprint at https://doi.org/arXiv:1804.02321 (2018).

Montanaro, A. Quantum speedup of branch-and-bound algorithms. Phys. Rev. Res. 2, 013056 (2020).

Ambainis, A. & Kokainis, M. Quantum algorithm for tree size estimation, with applications to backtracking and 2-player games. In Proceedings of the 49th Annual ACM SIGACT Symposium on Theory of Computing, STOC 2017, 989–1002 (Association for Computing Machinery, 2017); https://doi.org/10.1145/3055399.3055444.

Chakrabarti, S., Minssen, P., Yalovetzky, R. & Pistoia, M. Universal quantum speedup for branch-and-bound, branch-and-cut, and tree-search algorithms. Preprint at https://doi.org/arXiv:2210.03210 (2022).

Romeo, F. & Sangiovanni-Vincentelli, A. A theoretical framework for simulated annealing. Algorithmica 6, 302–345 (1991).

Levin, D. A. & Peres, Y. Markov Chains and Mixing Times, Vol. 107 (American Mathematical Society, 2017).

Somma, R. D., Boixo, S., Barnum, H. & Knill, E. Quantum simulations of classical annealing processes. Phys. Rev. Lett. 101, 130504 (2008).

Wocjan, P. & Abeyesinghe, A. Speedup via quantum sampling. Phys. Rev. A 78, 042336 (2008).

Harrow, A. W. & Wei, A. Y. Adaptive quantum simulated annealing for Bayesian inference and estimating partition functions. In Proceedings of the Fourteenth Annual ACM-SIAM Symposium on Discrete Algorithms 193–212 (Society for Industrial and Applied Mathematics, 2020); https://doi.org/10.1137/1.9781611975994.12.

Montanaro, A. & Pallister, S. Quantum algorithms and the finite element method. Phys. Rev. A 93, 032324 (2016).

Henderson, D., Jacobson, S. H. & Johnson, A. W. The Theory and Practice of Simulated Annealing 287–319 (Springer US, 2003); https://doi.org/10.1007/0-306-48056-5_10.

Li, Y., Protopopescu, V. A., Arnold, N., Zhang, X. & Gorin, A. Hybrid parallel tempering and simulated annealing method. Appl. Math. Comput. 212, 216–228 (2009).

Lemieux, J., Heim, B., Poulin, D., Svore, K. & Troyer, M. Efficient quantum Walk circuits for Metropolis–Hastings algorithm. Quantum 4, 287 (2020).

Dürr, C. & Høyer, P. A quantum algorithm for finding the minimum. Preprint at https://doi.org/arXiv/quant-ph/9607014 (1996).

Bulger, D., Baritompa, W. P. & Wood, G. R. Implementing pure adaptive search with Grover’s quantum algorithm. J. Optim. Theory Appl. 116, 517–529 (2003).

Gilliam, A., Woerner, S. & Gonciulea, C. Grover adaptive search for constrained polynomial binary optimization. Quantum 5, 428 (2021).

Grover, L. K. A fast quantum mechanical algorithm for database search. In Proceedings of the Twenty-Eighth Annual ACM Symposium on Theory of Computing, STOC ’96 212—219 (Association for Computing Machinery, 1996).

Ambainis, A. Quantum walk algorithm for element distinctness. SIAM J. Comput. 37, 210–239 (2007).

Sanders, Y. R. et al. Compilation of fault-tolerant quantum heuristics for combinatorial optimization. PRX Quantum 1, 020312 (2020).

Hastings, M. B. A short path quantum algorithm for exact optimization. Quantum 2, 78 (2018).

Dalzell, A. M., Pancotti, N., Campbell, E. T. & Brandão, F. G. S. L. Mind the gap: achieving a super-Grover quantum speedup by jumping to the end. Preprint at https://doi.org/arXiv:2212.01513 (2022).

Sanders, Y. R. et al. Compilation of fault-tolerant quantum heuristics for combinatorial optimization. PRX Quantum 1, 020312 (2020).

Kadowaki, T. & Nishimori, H. Quantum annealing in the transverse Ising model. Phys. Rev. E 58, 5355–5363 (1998).

Farhi, E., Goldstone, J., Gutmann, S. & Sipser, M. Quantum computation by adiabatic evolution. Preprint at https://doi.org/quant-ph/0001106 (2000).

Hegade, N. N. et al. Shortcuts to adiabaticity in digitized adiabatic quantum computing. Phys. Rev. Appl. 15, 024038 (2021).

Farhi, E., Goldstone, J. & Gutmann, S. A quantum approximate optimization algorithm. Preprint at https://doi.org/arXiv:1411.4028 (2014).

Hadfield, S. et al. From the quantum approximate optimization algorithm to a quantum alternating operator ansatz. Algorithms 12, 34 (2019).

Peruzzo, A. et al. A variational eigenvalue solver on a photonic quantum processor. Nat. Commun. 5, 4213 (2014).

Liu, X. et al. Layer VQE: a variational approach for combinatorial optimization on noisy quantum computers. IEEE Trans. Quantum Eng. 3, 3100920 (2022).

Yuan, X., Endo, S., Zhao, Q., Li, Y. & Benjamin, S. C. Theory of variational quantum simulation. Quantum 3, 191 (2019).

McArdle, S. et al. Variational ansatz-based quantum simulation of imaginary time evolution. npj Quantum Inf. 5, 75 (2019).

Benedetti, M., Fiorentini, M. & Lubasch, M. Hardware-efficient variational quantum algorithms for time evolution. Phys. Rev. Res. 3, 033083 (2021).

Bermejo, P. & Orús, R. Variational quantum continuous optimization: a cornerstone of quantum mathematical analysis. Preprint at https://doi.org/arXiv:2210.03136 (2022).

Fernández-Lorenzo, S., Porras, D. & García-Ripoll, J. J. Hybrid quantum–classical optimization with cardinality constraints and applications to finance. Quantum Sci. Technol. 6, 034010 (2021).

Niroula, P. et al. Constrained quantum optimization for extractive summarization on a trapped-ion quantum computer. Sci. Rep. 12, 17171 (2022).

Herman, D. et al. Portfolio optimization via quantum Zeno dynamics on a quantum processor. Preprint at https://doi.org/arXiv:2209.15024 (2022).

Tangpanitanon, J. et al. Hybrid quantum-classical algorithms for loan collection optimization with loan loss provisions. Preprint at https://doi.org/arXiv:2110.15870 (2021).

Drieb-Schön, M., Ender, K., Javanmard, Y. & Lechner, W. Parity quantum optimization: encoding constraints. Quantum 7, 951 (2023).

Bittel, L. & Kliesch, M. Training variational quantum algorithms is NP-hard. Phys. Rev. Lett. 127, 120502 (2021).

McClean, J. R., Boixo, S., Smelyanskiy, V. N., Babbush, R. & Neven, H. Barren plateaus in quantum neural network training landscapes. Nat. Commun. 9, 4812 (2018).

Larocca, M. et al. Diagnosing barren plateaus with tools from quantum optimal control. Quantum 6, 824 (2022).

You, X., Chakrabarti, S. & Wu, X. A convergence theory for over-parameterized variational quantum eigensolvers. In 26th Conference on Quantum Information Processing (TQC, 2023).

Denchev, V. S. et al. What is the computational value of finite-range tunneling? Phys. Rev. X 6, 031015 (2016).

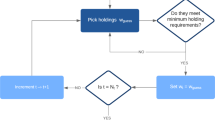

Mugel, S. et al. Hybrid quantum investment optimization with minimal holding period. Sci. Rep. 11, 19587 (2021).

Mugel, S. et al. Dynamic portfolio optimization with real datasets using quantum processors and quantum-inspired tensor networks. Phys. Rev. Res. 4, 013006 (2022).

Palmer, S. et al. Financial index tracking via quantum computing with cardinality constraints. Preprint at https://doi.org/arXiv:2208.11380 (2022).

Orús, R., Mugel, S. & Lizaso, E. Forecasting financial crashes with quantum computing. Phys. Rev. A 99, 060301 (2019).

Akshay, V., Rabinovich, D., Campos, E. & Biamonte, J. Parameter concentrations in quantum approximate optimization. Phys. Rev. A 104, L010401 (2021).

Basso, J., Farhi, E., Marwaha, K., Villalonga, B. & Zhou, L. The Quantum Approximate Optimization Algorithm at High Depth for Maxcut on Large-girth Regular Graphs and the Sherrington–Kirkpatrick Model (Schloss Dagstuhl — Leibniz-Zentrum für Informatik, 2022); https://drops.dagstuhl.de/opus/volltexte/2022/16514/.

Sureshbabu, S. H. et al. Parameter setting in quantum approximate optimization of weighted problems. Preprint at https://doi.org/arXiv:2305.15201 (2023).

Lykov, D. et al. Performance evaluation and acceleration of the QTensor quantum circuit simulator on GPUs. In 2021 IEEE/ACM Second International Workshop on Quantum Computing Software (QCS) (IEEE, 2021); https://doi.org/10.1109/qcs54837.2021.00007.

Lykov, D. & Alexeev, Y. Importance of diagonal gates in tensor network simulations. Preprint at https://doi.org/arXiv:2106.15740 (2021).

Lykov, D., Schutski, R., Galda, A., Vinokur, V. & Alexeev, Y. Tensor network quantum simulator with step-dependent parallelization. Preprint at https://doi.org/arXiv:2012.02430 (2020).

Lykov, D. et al. Performance evaluation and acceleration of the Q Tensor quantum circuit simulator on GPUs. 2021 IEEE/ACM Second International Workshop on Quantum Computing Software (QCS) (IEEE/ACM, 2021); https://doi.org/10.1109/qcs54837.2021.00007.

He, Z. et al. Alignment between initial state and mixer improves QAOA performance for constrained portfolio optimization. Preprint at https://doi.org/arXiv:2305.03857 (2023).

Cormen, T. H., Leiserson, C. E., Rivest, R. L. & Stein, C. Introduction to Algorithms (MIT Press, 2009).

Ambainis, A. et al. Quantum speedups for exponential-time dynamic programming algorithms. In Proceedings of the 2019 Annual ACM-SIAM Symposium on Discrete Algorithms (SODA) 1783–1793 (ACM-SIAM, 2019); https://epubs.siam.org/doi/abs/10.1137/1.9781611975482.107.

Mohri, M., Rostamizadeh, A. & Talwalkar, A. Foundations of Machine Learning (MIT Press, 2018).

Hastie, T., Tibshirani, R., Friedman, J. H. & Friedman, J. H. The Elements of Statistical Learning: Data Mining, Inference, and Prediction Vol. 2 (Springer, 2009).

Herman, D. et al. A survey of quantum computing for finance. Preprint at https://doi.org/arXiv:2201.02773 (2022).

Giovannetti, V., Lloyd, S. & Maccone, L. Quantum random access memory. Phys. Rev. Lett. 100, 160501 (2008).

Aaronson, S. Read the fine print. Nat. Phys. 11, 291–293 (2015).

Tang, E. Dequantizing algorithms to understand quantum advantage in machine learning. Nat. Rev. Phys. 4, 692–693 (2022).

Huang, H.-Y. et al. Power of data in quantum machine learning. Nat. Commun. 12, 2631 (2021).

Slattery, L. et al. Numerical evidence against advantage with quantum fidelity kernels on classical data. Preprint at https://doi.org/arXiv:2211.16551 (2022).

Gu, S., Kelly, B. & Xiu, D. Empirical asset pricing via machine learning. Rev. Financ. Stud. 33, 2223–2273 (2020).

Ghysels, E., Santa-Clara, P. & Valkanov, R. Predicting volatility: getting the most out of return data sampled at different frequencies. J. Econom. 131, 59–95 (2006).

Wiebe, N., Braun, D. & Lloyd, S. Quantum algorithm for data fitting. Phys. Rev. Lett. 109, 050505 (2012).

Wang, G. Quantum algorithm for linear regression. Phys. Rev. A 96, 012335 (2017).

Kerenidis, I. & Prakash, A. Quantum gradient descent for linear systems and least squares. Phys. Rev. A 101 (2020).

Date, P. & Potok, T. Adiabatic quantum linear regression. Sci. Rep. 11, 21905 (2021).

Han, J., Zhang, X.-P. & Wang, F. Gaussian process regression stochastic volatility model for financial time series. IEEE J. Sel. Top. Signal Process. 10, 1015–1028 (2016).

Zhao, Z., Fitzsimons, J. K. & Fitzsimons, J. F. Quantum-assisted Gaussian process regression. Phys. Rev. A 99, 052331 (2019).

Mitarai, K., Negoro, M., Kitagawa, M. & Fujii, K. Quantum circuit learning. Phys. Rev. A 98, 032309 (2018).

Abdou, H. A., Tsafack, M. D. D., Ntim, C. G. & Baker, R. D. Predicting creditworthiness in retail banking with limited scoring data. Knowl. Based Syst. 103, 89–103 (2016).

Awoyemi, J. O., Adetunmbi, A. O. & Oluwadare, S. A. Credit card fraud detection using machine learning techniques: a comparative analysis. In 2017 International Conference on Computing Networking and Informatics (ICCNI) 1–9 (ICCNI, 2017).

Li, T., Chakrabarti, S. & Wu, X. Sublinear Quantum Algorithms for Training Linear and Kernel-Based Classifiers (ICML, 2019).

Rebentrost, P., Mohseni, M. & Lloyd, S. Quantum support vector machine for big data classification. Phys. Rev. Lett. 113, 130503 (2014).

Havlíček, V. et al. Supervised learning with quantum-enhanced feature spaces. Nature 567, 209–212 (2019).

Wiebe, N., Kapoor, A. & Svore, K. Quantum algorithms for nearest-neighbor methods for supervised and unsupervised learning. Quantum Inf. Comput. 15, 316–356 (2015).

Ruan, Y., Xue, X., Liu, H., Tan, J. & Li, X. Quantum algorithm for K-nearest neighbors classification based on the metric of Hamming distance. Int. J. Theor. Phys. 56, 3496–3507 (2017).

Basheer, A., Afham, A. & Goyal, S. K. Quantum k-nearest neighbors algorithm. Preprint at https://doi.org/arXiv:2003.09187 (2020).

Farhi, E. & Neven, H. Classification with quantum neural networks on near term processors. Preprint at https://doi.org/arXiv:1802.06002 (2018).

Killoran, N. et al. Continuous-variable quantum neural networks. Phys. Rev. Res. 1, 033063 (2019).

Henderson, M., Shakya, S., Pradhan, S. & Cook, T. Quanvolutional neural networks: powering image recognition with quantum circuits. Quantum Mach. Intell. 2, 2 (2020).

Allcock, J., Hsieh, C.-Y., Kerenidis, I. & Zhang, S. Quantum algorithms for feedforward neural networks. ACM Trans. Quantum Comput. 1, 6 (2020).

Kerenidis, I., Landman, J. & Mathur, N. Classical and quantum algorithms for orthogonal neural networks. Preprint at https://doi.org/arXiv:2106.07198 (2021).

Schapire, R. E. & Freund, Y. Boosting: foundations and algorithms. Kybernetes 42, 164–166 (2013).

Schapire, R. E. The strength of weak learnability. Machine Learn. 5, 197–227 (1990).

Arunachalam, S. & Maity, R. Quantum boosting. In Proceedings of the 37th International Conference on Machine Learning, Vol. 119 of Proceedings of Machine Learning Research (eds Daumé, H. III & Singh, A.) 377–387 (PMLR, 2020); https://proceedings.mlr.press/v119/arunachalam20a.html.

Izdebski, A. & de Wolf, R. Improved quantum boosting. Preprint at https://doi.org/arXiv:2009.08360 (2020).

Servedio, R. A. Smooth boosting and learning with malicious noise. J. Machine Learn. Res. 4, 633–648 (2003).

Neven, H., Denchev, V. S., Rose, G. & Macready, W. G. Qboost: large scale classifier training with adiabatic quantum optimization. In Asian Conference on Machine Learning 333–348 (PMLR, 2012).

Leclerc, L. et al. Financial risk management on a neutral atom quantum processor. Preprint at https://doi.org/arXiv:2212.03223 (2022).

Friedman, J. H. Greedy function approximation: a gradient boosting machine. Ann. Stat. 29, 1189–1232 (2001).

Chen, T. & Guestrin, C. XGBoost. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining (ACM, 2016); https://doi.org/10.1145/2939672.2939785.

Davis, J., Devos, L., Reyners, S. & Schoutens, W. Gradient boosting for quantitative finance. J. Comput. Finance 24, 1–40 (2020).

Carmona, P., Climent, F. & Momparler, A. Predicting failure in the U.S. banking sector: an extreme gradient boosting approach. Int. Rev. Econ. Finance 61, 304–323 (2019).

Chang, Y.-C., Chang, K.-H. & Wu, G.-J. Application of extreme gradient boosting trees in the construction of credit risk assessment models for financial institutions. Appl. Soft Comput. 73, 914–920 (2018).

Gavrishchaka, V. V. Boosting-based frameworks in financial modeling: application to symbolic volatility forecasting. In Econometric Analysis of Financial and Economic Time Series (Emerald Group Publishing Limited, 2006).

León, D. et al. Clustering algorithms for risk-adjusted portfolio construction. Proc. Computer Sci. 108, 1334–1343 (2017).

Tola, V., Lillo, F., Gallegati, M. & Mantegna, R. N. Cluster analysis for portfolio optimization. J. Econ. Dyn. Control 32, 235–258 (2008).

Lloyd, S., Mohseni, M. & Rebentrost, P. Quantum algorithms for supervised and unsupervised machine learning. Preprint at https://doi.org/arXiv:1307.0411 (2013).

Kerenidis, I., Landman, J., Luongo, A. & Prakash, A. q-Means: a quantum algorithm for unsupervised machine learning. Preprint at https://doi.org/arXiv:1812.03584 (2018).

Khan, S. U., Awan, A. J. & Vall-Llosera, G. K-means clustering on noisy intermediate scale quantum computers. Preprint at https://doi.org/arXiv:1909.12183 (2019).

Kerenidis, I., Luongo, A. & Prakash, A. Quantum expectation-maximization for Gaussian mixture models. In Proceedings of the 37th International Conference on Machine Learning, vol. 119 of Proceedings of Machine Learning Research (eds Daumé, H. III & Singh, A.) 5187–5197 (PMLR, 2020); https://proceedings.mlr.press/v119/kerenidis20a.html.

Miyahara, H., Aihara, K. & Lechner, W. Quantum expectation-maximization algorithm. Phys. Rev. A 101, 012326 (2020).

Ng, A. Y., Jordan, M. I. & Weiss, Y. On spectral clustering: analysis and an algorithm. In Proceedings of the 14th International Conference on Neural Information Processing Systems: Natural and Synthetic 849–856 (ACM, 2001).

Daskin, A. Quantum spectral clustering through a biased phase estimation algorithm. TWMS J. Appl. Eng. Math. 10, 24–33 (2017).

Kerenidis, I. & Landman, J. Quantum spectral clustering. Phys. Rev. A 103, 042415 (2021).

Apers, S. & de Wolf, R. Quantum speedup for graph sparsification, cut approximation and Laplacian solving. In 2020 IEEE 61st Annual Symposium on Foundations of Computer Science (FOCS) 637–648 (IEEE, 2020).

Aïmeur, E., Brassard, G. & Gambs, S. Quantum clustering algorithms. In Proceedings of the 24th International Conference on Machine Learning (ACM, 2007); https://icml.cc/imls/conferences/2007/proceedings/papers/518.pdf.

Aïmeur, E., Brassard, G. & Gambs, S. Quantum speed-up for unsupervised learning. Mach. Learn. 20, 261–287 (2013).

Kumar, V., Bass, G., Tomlin, C. & Dulny, J. Quantum annealing for combinatorial clustering. Quantum Inf. Process. 17, 39 (2018).

Bermejo, P. & Orús, R. Variational quantum and quantum-inspired clustering. Preprint at https://arxiv.org/abs/2206.09893 (2022).

Goodfellow, I., Bengio, Y. & Courville, A. Deep Learning (MIT Press, 2016).

Benedetti, M. et al. A generative modeling approach for benchmarking and training shallow quantum circuits. npj Quantum Inf. 5, 45 (2019).

Coyle, B. et al. Quantum versus classical generative modelling in finance. Quantum Sci. Technol. 6, 024013 (2021).

Koller, D. & Friedman, N. Probabilistic Graphical Models: Principles and Techniques (The MIT Press, 2009).

Zhu, E. Y. et al. Generative quantum learning of joint probability distribution functions. Preprint at https://doi.org/arXiv:2109.06315 (2021).

Kyriienko, O., Paine, A. E. & Elfving, V. E. Protocols for trainable and differentiable quantum generative modelling. Preprint at https://doi.org/arXiv:2202.08253 (2022).

Low, G. H., Yoder, T. J. & Chuang, I. L. Quantum inference on Bayesian networks. Phys. Rev. A 89, 062315 (2014).

Tucci, R. R. Quantum Bayesian nets. Int. J. Mod. Phys. B 09, 295–337 (1995).

Borujeni, S. E., Nannapaneni, S., Nguyen, N. H., Behrman, E. C. & Steck, J. E. Quantum circuit representation of Bayesian networks. Exp. Syst. Appl. 176, 114768 (2021).

Klepac, G. The Schrödinger equation as inspiration for a client portfolio simulation hybrid system based on dynamic Bayesian networks and the REFII model. In Quantum Inspired Computational Intelligence Ch. 12, 391–416 (Morgan Kaufmann, 2017).

Moreira, C. & Wichert, A. Quantum-like Bayesian networks for modeling decision making. Front. Psychol. 7, 11 (2016).

Hinton, G. E. Training products of experts by minimizing contrastive divergence. Neural Comput. 14, 1771–1800 (2002).

Salakhutdinov, R. & Hinton, G. Deep Boltzmann machines. In Proceedings of the Twelth International Conference on Artificial Intelligence and Statistics, Vol. 5, 448–455 (PMLR, 2009).

Benedetti, M., Realpe-Gómez, J., Biswas, R. & Perdomo-Ortiz, A. Estimation of effective temperatures in quantum annealers for sampling applications: a case study with possible applications in deep learning. Phys. Rev. A 94, 022308 (2016).

Dixit, V., Selvarajan, R., Alam, M. A., Humble, T. S. & Kais, S. Training restricted Boltzmann machines with a d-wave quantum annealer. Front. Phys. 9, 589626 (2021).

Amin, M. H., Andriyash, E., Rolfe, J., Kulchytskyy, B. & Melko, R. Quantum Boltzmann machine. Phys. Rev. X 8, 021050 (2018).

Zoufal, C., Lucchi, A. & Woerner, S. Variational quantum Boltzmann machines. Quantum Mach. Intell. 3, 7 (2021).

Lloyd, S. & Weedbrook, C. Quantum generative adversarial learning. Phys. Rev. Lett. 121, 040502 (2018).

Guyon, I., Gunn, S., Nikravesh, M. & Zadeh, L. A. Feature Extraction: Foundations and Applications Vol. 207 (Springer, 2008).

Lloyd, S., Mohseni, M. & Rebentrost, P. Quantum principal component analysis. Nat. Phys. 10, 631–633 (2014).

Yu, C., Gao, F. & Lin, Sea Quantum data compression by principal component analysis. Quantum Inf. Process. 18, 249 (2019).

Lin, J., Bao, W.-S., Zhang, S., Li, T. & Wang, X. An improved quantum principal component analysis algorithm based on the quantum singular threshold method. Phys. Lett. A 383, 2862–2868 (2019).

Martin, A. et al. Toward pricing financial derivatives with an IBM quantum computer. Phys. Rev. Res. 3, 013167 (2021).

Carlsson, G. Topological methods for data modelling. Nat. Rev. Phys. 2, 697–708 (2020).

Lloyd, S., Garnerone, S. & Zanardi, P. Quantum algorithms for topological and geometric analysis of data. Nat. Commun. 7, 10138 (2016).

McArdle, S., Gilyén, A. & Berta, M. A streamlined quantum algorithm for topological data analysis with exponentially fewer qubits. Preprint at https://doi.org/arXiv:2209.12887 (2022).

Grossi, M. et al. Mixed quantum–classical method for fraud detection with quantum feature selection. IEEE Trans. Quantum Eng. 3, 3102812 (2022).

Dacrema, M. F. et al. Towards feature selection for ranking and classification exploiting quantum annealers. In Proceedings of the 45th International ACM SIGIR Conference on Research and Development in Information Retrieval (ACM, 2022).

Zoufal, C. et al. Variational quantum algorithm for unconstrained black box binary optimization: application to feature selection. Quantum 7, 909 (2023).

Mücke, S., Heese, R., Müller, S., Wolter, M. & Piatkowski, N. Feature selection on quantum computers. Quantum Mach. Intell. 5, 11 (2023).

Sutton, R. S. & Barto, A. G. Reinforcement Learning: An Introduction (MIT Press, 2018).

Halperin, I. QLBS: Q-learner in the Black–Scholes(-Merton) worlds. J. Deriv. 28, 99–122 (2020).

Buehler, H., Gonon, L., Teichmann, J. & Wood, B. Deep hedging. Quant. Finance 19, 1271–1291 (2019).

Benhamou, E., Saltiel, D., Ohana, J. J., Atif, J. & Laraki, R. Deep reinforcement learning (DRL) for portfolio allocation. In Joint European Conference on Machine Learning and Knowledge Discovery in Databases, 527–531 (Springer, 2020).

Deng, Y., Bao, F., Kong, Y., Ren, Z. & Dai, Q. Deep direct reinforcement learning for financial signal representation and trading. IEEE Trans. Neural Netw. Learn. Syst. 28, 653–664 (2016).

Zhang, Z., Zohren, S. & Roberts, S. Deep reinforcement learning for trading. J. Financ. Data Sci. 2, 25–40 (2020).

Spooner, T., Fearnley, J., Savani, R. & Koukorinis, A. Market making via reinforcement learning. In Proceedings of the 17th International Conference on Autonomous Agents and MultiAgent Systems 434–442 (International Foundation for Autonomous Agents and Multiagent Systems, 2018).

Abe, N. et al. Optimizing debt collections using constrained reinforcement learning. In Proceedings of the 16th ACM SIGKDD International Conference on Knowledge Discovery and Data Mining 75–84 (ACM SIGKDD, 2010).

Kolm, P. N. & Ritter, G. Modern perspectives on reinforcement learning in finance (September 6, 2019). J. Mach. Learn. Finance https://dx.doi.org/10.2139/ssrn.3449401 (2020).

Dong, D., Chen, C., Li, H. & Tarn, T.-J. Quantum reinforcement learning. IEEE Trans. Systems Man Cybern. Part B (Cybern.) 38, 1207–1220 (2008).

Cornelissen, A. Quantum Gradient Estimation and Its Application to Quantum Reinforcement Learning. Master’s thesis, Delft University of Technology (2018).

Paparo, G. D., Dunjko, V., Makmal, A., Martin-Delgado, M. A. & Briegel, H. J. Quantum speedup for active learning agents. Phys. Rev. X 4, 031002 (2014).

Chen, S. Y.-C. et al. Variational quantum circuits for deep reinforcement learning. IEEE Access 8, 141007–141024 (2020).

Chen, S. Y.-C., Huang, C.-M., Hsing, C.-W., Goan, H.-S. & Kao, Y.-J. Variational quantum reinforcement learning via evolutionary optimization. Mach. Learn. Sci. Tech. 3, 015025 (2021).

Lockwood, O. & Si, M. Reinforcement learning with quantum variational circuits. In Proceedings of the AAAI Conference on Artificial Intelligence and Interactive Digital Entertainment Vol. 16, 245–251 (AAAI Press, 2020); https://doi.org/10.1609/aiide.v16i1.7437

Jerbi, S., Trenkwalder, L. M., Poulsen Nautrup, H., Briegel, H. J. & Dunjko, V. Quantum enhancements for deep reinforcement learning in large spaces. PRX Quantum 2, 010328 (2021).

Jerbi, S., Gyurik, C., Marshall, S., Briegel, H. & Dunjko, V. Parametrized quantum policies for reinforcement learning. Adv. Neural Inf. Process. Syst. 34, 28362–28375 (2021).

Crawford, D., Levit, A., Ghadermarzy, N., Oberoi, J. S. & Ronagh, P. Reinforcement learning using quantum Boltzmann machines. Quantum Inf. Comput. 18, 51–74 (2018).

Cherrat, E. A. et al. Quantum deep hedging. Preprint at https://doi.org/arXiv:2303.16585 (2023).

Tang, E. A quantum-inspired classical algorithm for recommendation systems. In Proceedings of the 51st Annual ACM SIGACT Symposium on Theory of Computing (Association for Computing Machinery, 2019).

Chia, N.-H. et al. Sampling-based sublinear low-rank matrix arithmetic framework for dequantizing quantum machine learning. In Proceedings of the 52nd Annual ACM SIGACT Symposium on Theory of Computing (2020).

Arrazola, J. M., Delgado, A., Bardhan, B. R. & Lloyd, S. Quantum-inspired algorithms in practice. Quantum 4, 307 (2020).

Isenhower, L., Saffman, M. & Mølmer, K. Multibit CkNOT quantum gates via Rydberg blockade. Quantum Inf. Process. 10, 755–770 (2011).

Goel, N. & Freericks, J. K. Native multiqubit Toffoli gates on ion trap quantum computers. Quantum Sci. Technol. 6, 044010 (2021).

Roy, T. et al. Programmable superconducting processor with native three-qubit gates. Phys. Rev. Appl. 14, 014072 (2020).

Haener, T., Soeken, M., Roetteler, M. & Svore, K. M. Quantum circuits for floating-point arithmetic. In Reversible Computation: 10th International Conference, RC 2018 162–174 (Springer, 2018).

Jaques, S. & Rattew, A. G. QRAM: a survey and critique. Preprint at https://doi.org/arXiv:2305.10310 (2023).

Acknowledgements

The authors appreciate support from the Chicago Quantum Exchange. Y.A. acknowledges support from the Office of Science, US Department of Energy, under contract DE-AC02-06CH11357 at Argonne National Laboratory. D.H., Y.S. and M.P. appreciate the insightful discussions they had with their colleagues from the Global Technology Applied Research centre at JPMC.

Author information

Authors and Affiliations

Contributions

D.H., C.G., X.L. and Y.S. contributed equally to all aspects of the article. All authors contributed to the writing of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The author declare no competing interests.

Peer review

Peer review information

Nature Reviews Physics thanks the anonymous reviewers for their contribution to the peer review of this work.

Additional information

Disclaimer This paper was prepared for informational purposes with contributions from the Global Technology Applied Research Center of JPMorgan Chase & Co. This paper is not a product of the Research Department of JPMorgan Chase & Co. or its affiliates. Neither JPMorgan Chase & Co. nor any of its affiliates makes any explicit or implied representation or warranty and none of them accepts any liability in connection with this paper, including, without limitation, with respect to the completeness, accuracy or reliability of the information contained herein and the potential legal, compliance, tax or accounting effects thereof. This document is not intended as investment research or investment advice, or as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, financial product or service, or to be used in any way for evaluating the merits of participating in any transaction.

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Glossary

- Autocallable

-

A financial product that pays the holder a high return if the value of the underlying asset passes an upside barrier.

- Black–Scholes model

-

A mathematical model for the dynamics of a financial market containing derivative investment instruments.

- Bump-and-reprice

-

A method to estimate the sensitivity of the price of a financial derivative with respect to an underlying parameter by evaluating the price at different values of the parameter and taking the difference.

- Financial derivative

-

A financial contract that derives its value from the performance of an underlying entity.

- Hamilton–Jacobi–Bellman equation

-

An equation that gives a necessary and sufficient condition for optimality of a control with respect to a loss function.

- Martingale measure

-

A probability measure such that the conditional expectation of a random variable in a sequence given the value of a random variable prior in the sequence is equal to the value of this prior random variable on which the expectation is conditioned.

- Option

-

A financial contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at an agreed-upon price and time frame.

- Target accrual redemption forward

-

A financial product that allows the holder to achieve a target rate (interest rate, exchange rate and so on) or rate range on a pre-defined schedule (for example, monthly) up to a limit on the maximum payout and under certain conditions on the extreme values of the rate observed in the market (spot rate). It achieves this goal by paying the holder a positive amount if the spot rate is higher than a target value and negative if lower, until the maximum amount of accrual has been reached or the spot rate hits certain upper and/or lower barriers.

- Vapnik–Chervonenkis (VC) dimension

-

A measure of the capacity of a set of functions that can be learnt by a statistical binary classification algorithm, defined as the cardinality of the largest set of data points that the algorithm can always learn a perfect classifier for an arbitrary labelling.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Herman, D., Googin, C., Liu, X. et al. Quantum computing for finance. Nat Rev Phys 5, 450–465 (2023). https://doi.org/10.1038/s42254-023-00603-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s42254-023-00603-1

This article is cited by

-

An elementary review on basic principles and developments of qubits for quantum computing

Nano Convergence (2024)

-

Harnessing quantum information to advance computing

Nature Computational Science (2024)

-

Quantum machine learning in spatial analysis: a paradigm shift in resource allocation and environmental modeling

Letters in Spatial and Resource Sciences (2024)

-

Quantum-inspired meta-heuristic approaches for a constrained portfolio optimization problem

Evolutionary Intelligence (2024)

-

DOA Estimation in the Presence of Doppler Shifts Using Quantum-Inspired Swarm Intelligence Algorithms

SN Computer Science (2024)