Abstract

This study aims to estimate the net effect of China’s entrepreneurship policy on back-home migrant workers since 2015. Using survey data from the provinces of; Zhejiang, Henan, and Guizhou with propensity score matching to control selection bias, the study indicates that the overall entrepreneurship policy has a significant positive impact on the probability of entrepreneurial entry. The poverty alleviation effect of the overall policy is greater than its industrial development effect, while the employment effect is not significant. The infrastructure policy’s effect on employment, industrial development, and poverty alleviation is greater than the other policies, and the financial policy’s effect on these three aspects is not significant. This study contributes to the existing literature by addressing a well-defined gap regarding the net effect of entrepreneurship policy on entrepreneurship entry and provides well-supported and plausible explanations for the inconsistencies among previous studies on policy effect indicators. As a practical contribution, this study provides China and other developing economies with compelling empirical evidence to support the design and amendment of entrepreneurship policy at the national level.

Similar content being viewed by others

Introduction

Evaluating the effectiveness of public policy can be accomplished by an assessment of how well the policy objectives have been met. Known as the ex-post evaluation, this process is typically done after the policy implementation has been completed and the results are apparent. Effectiveness evaluation is the most meaningful among the three kinds of evaluation, which include prior, in-progress, and ex-post, and is the best way to test a policy’s effectiveness, efficiency, and benefit as well as the basis for policy adjustment or suspension. Importantly, ex-post evaluation is frequently used as the basis for future resource allocation. However, public policy evaluation is often difficult to complete due to political conflicts of interest, financial budget constraints, methodological difficulty in identifying the policy causation, difficulty in obtaining policy data, and the diversity of policy impact.

The same difficulties exist in assessing entrepreneurial policies. Due to the lack of large samples and high-quality data, most of the existing effectiveness assessments of public policies on entrepreneurship are descriptive (Mirzanti, et al., 2018; Goetz, et al., 2010), and some studies attempt to make up for the data deficiencies by constructing new evaluation models (Dewi and Hanifah, 2022; Smallbone, 2020). The literature on evaluating the effect of entrepreneurship policies with methodological rigor is sparse (Rigby and Ramlogan, 2016). There appear to be no relevant studies in the recent literature on the net effect of entrepreneurship policies on “new venture creation,” the most important objective of entrepreneurship policies. Moreover, as presented in the literature review, the very limited existing research on the impact of entrepreneurial policies on the performance of new ventures has not reached a consensus, which means that there is a need for further exploration in this area.

We address these gaps by evaluating the effect of China’s policies for back-home migrant workers’ entrepreneurship (BHMWE).Footnote 1 There are several methodological advantages in evaluating China’s policies for BHMWE. Firstly, there is a large policy portfolio covering the entire process of preparation, implementation, and development of entrepreneurship which makes it possible to evaluate the net effect of the policies on entrepreneurship entry, and of the main policy instruments on nascent firms’ economic performance as well. Secondly, most of the major policies in this policy portfolio were promulgated in 2015–2016. By the time the data was gathered for this study in early 2021, sufficient time had elapsed for the policy effects to become apparent, and also recent enough to enable entrepreneurs to provide accurate information on corporate performance and policy participation. Thirdly, the entrepreneurship policies cover a large population group, which enables us to obtain samples large enough to compare the treatment group and the control group, thus, technically eliminating the self-selection bias. The differences in economic development in eastern, central, and western China also make it possible for us to test the heterogeneity of policy effects.Footnote 2

Given that we need to assess the effectiveness of China’s policies for BHMWE, our research will be evidence-producing, rather than hypothesis-testing. That is, the research question in this study is to what extent the implementation of the entrepreneurship policy has achieved the intended policy objectives, or more precisely, what is the net increment in the behavioral performance of entrepreneurship policy participants minus the behavioral performance had he or she not participated in the entrepreneurship policy, rather than why and how the policies worked. Our evidence indicates that the awareness of entrepreneurship policies has a significant positive impact on the probability of BHMWE, the net effects between different matching methods and in different regions are different though, there is a robust consistency in the estimated values. The impact of entrepreneurship policies, including the overall and specific policy instruments on the performance of new ventures is quite different. Most policy instruments have significant positive effects on employment, sales, and pretax profit of new firms, with the exception of financial policy, which we find had no significant effects on either of the three economic indicators.

The major contribution of this study to the existing literature is the estimation of the net effect of entrepreneurship policy on the “new venture creation”. This is a key indicator in measuring the effect of entrepreneurship policy, bridging the gap on this key indicator in the existing literature, and providing clear evidence for the effectiveness of entrepreneurship policy. Secondly, by taking advantage of a large sample size and multi-covariate analysis, the study conducts strict matching, and robust estimates of the impacts of policy on other indicators, such as the number of employees. This enables the development of plausible explanations for the inconsistencies among previous related research. Thirdly, this study includes an in-depth and thorough test of the effectiveness of a policy portfolio. Policy variables include not only policies such as fiscal subsidies and financial support, but also non-financial policies such as entrepreneurship training and policy consultation, and comprehensive policies with entrepreneurship incubation as the main content. This provides systemic implications for the design and adjustment of entrepreneurship policies in China, and in other developing countries as well.

Literature review

Given that the purpose of this study is to identify the “additionality” or “net” values of entrepreneurship policy effect, the literature was screened in two steps: First, the keywords “entrepreneurship policy”, “policy effect”, “business performance” and“policy impact” were used to conduct a preliminary screening of the existing published research both in WOB and CNKI over a 20 year period, from 2002 to 2022. Second, after reviewing the flagged publications, those articles that were not methodologically related to the“net effect” were eliminated from further inclusion. Therefore, papers included in the literature analysis are those methodologically employing either randomized experiments, pre-test and post-test comparison of an experimental group, or the data of the experimental group and the matching comparison group, or any econometric approach by which self-selection bias could be eliminated. The papers included in the literature analysis must be methodologically rigorous, or at least those that could be classified as a causal inference analysis in a relatively rigorous sense.

Assessments of Financial-related policies

Caliendo and Kunn (2011) examined the employment outcomes for participants in the Programme of startup subsidies, and bridging allowances in Germany using propensity score matching and difference-in-differences methods. Their study found that the probability of being not-unemployed was 15.6% higher among recipients of the startup subsidy and 10.6% higher among those receiving the bridging allowance, relative to the control group. In terms of labour market integration, the probability of employment was 22.1% higher among participants in the startup subsidy Programme and 14.5% higher among participants in the bridging allowance Programme than the non-participant group. In terms of income, the monthly wage income of startup subsidy and bridging allowance participants was €435 and €618 higher, respectively, than that of non-participants, and the total income (income from self or paid employment plus transfer payments) was €270 and €485 higher, respectively. Figueroa-Armijos and Johnson (2016) applied a spatial difference-in-differences statistical technique to calculate the effects of the Entrepreneurship Community Partnership Tax Credit Programme on participating counties in Kansas, USA. The study’s dependent variables included: proprietors’ income growth per capita, personal income growth per capita, employment growth, growth in the number of proprietors per capita, and growth in average earnings per job. Their findings showed that only one indicator, personal income growth per capita, was significant (p < .01), and even that had a diminishing effect over time. However, given the overall result of the regression, the researchers considered this solitary effect of per capita income to be inconclusive. All results of the spatial lag model, spatial error model, and non-spatial model were consistent. Wu and Huang (2018) analysed the entrepreneurship policies included in the “Mass Entrepreneurship and Innovation” platform. Upon completion of a Ridit analysis, they reported that “optimizing fiscal and tax policies” was the focus of the current entrepreneurship policies at all administrative levels. When the same study subsequently analysed the average treatment effect on the treated (ATT) of the fiscal and tax policy with propensity score matching, the results indicated that the ATT of the fiscal and tax policy was 147.63, meaning that the average profit of enterprises benefiting from the fiscal and tax policy was RMB 1.4764 million higher than that of the matched enterprises that were not. The average effect of fiscal and tax policy awareness was −97.58, meaning that the average profits of enterprises that “did not know” about the fiscal and tax policy were RMB 975,800 lower than that of the matched enterprises that did.

Assessments of non-financial policies

Wren and Storey (2002) examined the impact of the UK Enterprise Initiative, a publicly supported advisory Programme, on the performance of SMEs and found that the scheme had positive impacts on the performance of the experimental group of firms. The authors observed that the initiative had no effect on the survival rates for smaller firms, but medium-sized firms were 4% more likely to survive over the longer term than the control group. Their corrected regression analyses indicated that the policy support impacted sales and employment but varied by firm size. Roper and Hart (2005) evaluated the effects of the Business Link Programme on small firms in England during the 1996 to 1998 period. They found that the Programme had no significant effect on small firms’ sales, employment, or productivity growth. By contrast, excluding the control for selection bias resulted in positive employment growth from the Business Link assistance during that period. Mole et al. (2008) conducted a follow-up study on the Business Link Programme by investigating the types of firms using the advisory services Programme for SMEs, the types of firms benefiting most from such support, and the impact of Programme participation on sales and employment growth. They employed a non-experimental approach with a regression model to control for group differences and Difference-In-Differences methods to eliminate potential bias from the unobserved variables. Ordinary Least Squares (OLS) results indicated that more intensive application of assistance from the Business Link Programme had a positive and significant impact on employment growth but not on the growth of sales. A Difference-in-Differences analysis showed that the average number of employees in the firms receiving assistance from the Business Link Programme increased by 4.4% relative to the control group. However, the employment effect varied significantly across firms with differing types of corporate strategies. Denmark’s North Jutland Entrepreneurial Network, an advisory and mentoring Programme for entrepreneurs, offers three different levels of counselling products: L1-Basic counselling; L2-Follow-up counselling and L3-Extended counselling for entrepreneurs during the startup process. Rotger et al. (2012) analysed the marginal effects of different levels by using a matching method and found that the two-year survival rate of L2 participants increased by about 8%, and the four-year survival rate increased by 5.2%, while for the L3 participants the two-year survival rate increased by 7.6% and the four-year survival rate by 6.4%. For the 2002–2003 cohort, the average effect of L2 participants on employment was 0.5, but this increase was short-term, and the coefficient was not significant in the longer term. The employment effect of L3 participants was not significant in the early stages but became significant after the second and third years. The output effect of L2 and L3 was positive and significant, but the output effect of L2 started to decline after one year, at which time that of L3 started to rise. Fairlie et al. (2015) used experimental data from the GATE (Growing America Through Entrepreneurship) project to analyse the effect of entrepreneurship training. GATE is a pilot Programme Organised by the Department of labour and the Small Business Administration. In the Fairlie et al. research, 4198 applicants were randomly assigned to either a treatment or a control group. Their findings suggest that the GATE project’s impact on final output would be limited. Initially, they found a positive effect of business training which dissipated over the longer term. Fang (2021) empirically tested the income effect of entrepreneurship training based on the survey data of BHMWE in 2019 and found that entrepreneurship training could significantly improve the performance of BHMWE. Additionally, participation in entrepreneurship training improved the ability of back-home migrant workers to gain access to government policies regarding support Programmes and regulatory matters related to new venture development, which improved the performance of BHMWE.

Assessments of multiple instrument policies

Amezcua (2010) examined 950 incubators and 19,000 incubated firms in the United States as the treatment group and a group of matched non-incubated firms as a control group to examine the survival, employment growth, and sales growth of new firms. The findings indicate that incubation reduced the firms’ life expectancy but increased the firms’ employment and sales growth rate. The same study also found that certain types of incubators produced better-performing new businesses and that women-owned businesses benefited more from incubators than male-owned ones. A similar study by Schwartz (2013) using a sample of 371 firms in each of the experimental and control groups, incubated and non-incubated, respectively, in Germany found no significant difference in survival rates between startups that were incubated and those that were not. Their analysis also showed that incubated firms had a statistically significant lower survival rate at three different incubator locations. Autio and Rannikko (2016) analysed the impact of a six-year high-growth entrepreneurship policy in Finland on the firms’ sales growth. Using an eight-year panel that started two years before the initiative began, and propensity score matching to control selection bias, they found that the sales growth of the treated group was 120 percentage points higher than that of the control group over a two-year time span, and 130 percentage points over the control group over three years.

Comments

A comprehensive review of related literature reveals that the existing research using causal inference analysis in the strict sense is limited. Within a 20-year period, only 12 such papers were found, among which there are three papers on the effects of financial-related policies, six on the effects of non-financial policies, and three papers on the effects of multiple instruments policies. Among the nine micro-level studies, indicators to measure the effects of entrepreneurship policies include the number of employees (five papers), sales revenue (six papers), firm’s survival rate (five papers), profit (one paper), and productivity (one paper). The three papers on regional-level Programme effect used other indicators. No research was found in the literature on the impact of entrepreneurship policies on entrepreneurial entry. There is no clear consensus among the current studies on the effects of entrepreneurship policies. From the perspective of firm survival, one study (Rotger, Gørtz, and Storey 2012) found that entrepreneurship policies could effectively improve a firm’s survival. Two studies (Fairlie, Karlan, and Zinman 2015; Wren and Storey 2002) found that entrepreneurship policies had no significant impact on a firm’s survival. From the perspective of sales revenue, one study (Fang 2021) indicated that entrepreneurship policies could significantly improve a firm’s sales revenue. Two studies (Mole et al. 2008; Roper and Hart 2005) found that entrepreneurship policies had no significant impact on sales revenue. Wren and Story (2002) found that the impact of entrepreneurship policies on sales revenue depended on firm size; policy participation could increase the sales revenue of small enterprises but had no significant impact on the sales revenue of large enterprises. In terms of the number of employees, all studies examined found that entrepreneurship policies could significantly expand the size of enterprises.

The relative under-exploration of the net effects of entrepreneurship policies is likely related to the difficulty in accessing large samples and high-quality data. In terms of the indicators measuring the net effect of entrepreneurship policy, regrettably, it appears there are no studies on entrepreneurial entry because, in essence, the most critical indicator to measure the effect of entrepreneurship policy should be the extent to which it increases the number of entrepreneurial ventures.

The lack of consensus among the existing research can likely be explained by three factors. Firstly, the heterogeneity of the research subjects. For different entrepreneurship policies, different economic and social environments in different countries and regions, and different entrepreneurial subjects, the size and direction of the effect of policy are bound to be different. For these reasons, there exists a need to explore the effects of different entrepreneurship policies in different countries. Secondly, the rigour of methodologies. For example, Fang (2021) used discrete values of 1–9 to represent the level of enterprise income, which could not clearly explain the economic meanings of the average treatment effect on the treated (ATT) of training participation. PSM-DID was used to estimate the ATT of training participation, but there were only four covariates in the study, which was barely sufficient to meet the CIA condition of PSM estimation and thus inevitably impaired the accuracy of statistical inference. Thirdly, in some studies, the subjects in question were beyond the category of entrepreneurial enterprises. For example, Autio and Rannikko (2016), where despite overcoming the selection bias problem and having good internal validity, the average maturity of the sample companies was between 4.2 years and 6.7 years. If measured by the Global Entrepreneurship Monitor’s criteria, those companies would not be considered startups but would be classified as small and medium-sized enterprises (SMEs). Making causal inferences based on SME performance indicators will likely distort and amplify the effect of entrepreneurship policy.

This study will examine the net effect of entrepreneurship policies on new venture creation, a key indicator of entrepreneurship policy effect, to address the gap in the existing research on entrepreneurship entry. This study also tests the impact of entrepreneurship policies on other policy effect indicators such as the number of employees, providing compelling evidence through the use of large samples, multiple covariates, and rigorous matching procedures. By doing so, this study provides plausible explanations for the inconsistencies among prior studies on the topic.

Methodology

The area of exploration in this study is essentially the estimation of the average treatment effect of entrepreneurship policy. Because the sample data cannot meet the requirement of randomness, the average treatment effect of entrepreneurship policy cannot be conclusively ascertained by subtracting the outcome of the non-participants from the outcome of the participants. If Y1 represents the average outcome of the entrepreneurship policy participants, \({Y}^{0}\) represents the average outcome of the non-participants, D is the participation variable of entrepreneurship policy, when participating in policy, D = 1, not participating, D = 0. Theoretically, the average treatment effect on the treated (ATT) of the entrepreneurship policy should be equal to the average outcome of the policy participants minus the average outcome of the same cohort of participants if they had not participated:

In Eq. 1, the second term on the right-hand side is impossible to observe. What can be observed is the outcome of non-participants in entrepreneurship policy. Subtracting the average outcome of non-participants from the average outcome of participants in entrepreneurship policy yields Eq. 2:

The second term on the right-hand side of Eq. 2 is the self-selection bias. If this term is positive, it indicates the existence of the so-called endogenous bias; if this term is negative, it indicates the existence of the so-called inverse endogenous bias. As long as the second term is not zero, the authenticity of the inference is going to be harmed. In this study, the self-selection bias is likely to be positive. That is, those returnees with stronger entrepreneurial intentions, more human capital, and more entrepreneurial resources are more likely to choose to start a business. Those enterprises that were started earlier and have operated for a longer time, achieved greater growth, better performance, and reached the eligibility threshold for entrepreneurship policies, are thus more likely to make more use of and benefit more from the entrepreneurship policies. In empirical studies, propensity score matching (PSM) is often used to mitigate the self-selection bias caused by observable factors.

A propensity score is defined as “the probability of an individual receiving a certain treatment based on his own observed characteristics.” Essentially, a one-dimensional variable, the propensity score, P(x) is used to replace multidimensional covariates X.

Therefore, the ATT of entrepreneurship policy can be reformulated as shown in Eq. 4.

Where D is a binary dummy variable of participation in entrepreneurship policy (overall policy or specific policy), and X is a covariant vector that may influence policy outcomes (probability of entrepreneurial entry, number of employees, sales revenue, and profit before tax) and/or participation in policy. The purpose of the measurement is to evaluate the net impact of D on the outcomes of entrepreneurship policy. Since it is assumed that the participation variable D is not correlated with the covariates or the error term, the estimated coefficient of D is the participation effect of entrepreneurship policy.

The basic idea of propensity score matching is that if two individuals have the same propensity score, one in the treated group and another in the control group, then the experiment can be considered as random, and Y0, as the participating individual’s counterfactual is accurate, making the average treatment effect accurate. To employ PSM, two conditions must be met. Firstly, the Conditional Independence Assumption (CIA), means that the outcome is independent of the participation variables when conditional on covariates. To satisfy this assumption, a substantial number of covariates are required, the omission of some critical covariates may lead to an incorrect estimate of the propensity score (Criscuolo et al. 2019). When estimating the average outcome effect of the entrepreneurship policies, a total of 18 covariates were selected. Each was either correlated with both the participation variables and the outcomes or unrelated to the participation variables but correlated with the outcomes. Therefore, there exists a high level of reliability that the CIA is supported. Secondly, the Common Support Condition. For purposes of this study, individual characteristics do not entirely determine participation in entrepreneurship policy. Each participant may find a counterfactual, and the matching must be carried out within the common support domain. This study reports both the average treatment effect of the entrepreneurship policy and the sample size of both the treated and control groups within the common support domain and requires that all variable means do not deviate 10% between the treated and control groups after matching.

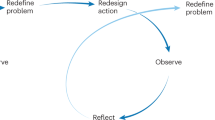

To ensure robustness, both the nearest neighbour matching and kernel matching are used to estimate the ATT. Bootstrap methodology is applied to calculate the standard error and statistical significance, and the matching quality is also tested and reported in the final step. The process of policy effect estimation is shown in Fig. 1.

Sample and data

Questionnaire

Primary data for this study was collected via a survey of migrant workers and the entrepreneurs among them. The questionnaire was developed as a collaborative effort by several experts in the field. After the preliminary version was completed, validity was tested on a small scale and revisions were made to some questions for clarity and simplicity. For example, “green channel policy” was used to refer to business environment policy, “infrastructure policy” to refer to incubation policy, and “talent policy” to refer to human resources policies such as training activity. Because it is difficult for respondents to distinguish the public service and organizational support policies that specifically targeted entrepreneurial activities from those serving other purposes. In order to ensure the reliability of the responses, questions about “public service policies” and “organizational support policies” were not included in the questionnaire, although those two types of policies are important components of the overall entrepreneurship policy system of China. The initial four questions of the survey were designed to ensure that the respondents were part of the target demographic, being either migrant workers or back-home entrepreneurs under the age of 40. The questions included: “Are you between the ages of 16 and 40?”, “Have you ever worked outside of your home county?”, “Are you working or starting a business in the county where you are registered?”, Moreover, “Are you an agricultural hukou,Footnote 3or were you an agricultural hukou before you changed to a residential hukou?”. The final version of the questionnaire includes a total of 38 questions in four parts: demographic information, employment outside his or her county, entrepreneurship, and finally, policy participation.

Sample and data

The samples are drawn from Zhejiang, Henan, and Guizhou provinces, respectively representing the eastern, central, and western regions of China with large differences in economic development levels. The survey team was comprised of students from colleges and universities in the three provinces. All the members were originally from rural areas. Each student was required to gather data in his/her village (town) and the vicinity. Data collection was conducted in one of three ways; face-to-face, telephone, or online. Online surveys were completed under the guidance of the survey team member. The survey period was from mid-November of 2020 to mid-March 2021, during which a total of 4176 completed questionnaires were collected. Some responses were determined to be invalid, typically due to incompleteness or illegibility. After eliminating the invalid responses, 3693 valid responses remained, including; 1188 from eastern China, 1194 from central China, and 1311 from western China. There were 868 completed surveys identified as meeting the criteria for inclusion as entrepreneurs.

Cronbach’s Alpha coefficient was used to assess the reliability of the questionnaire. By calculation, Cronbach’s Alpha coefficient of entrepreneurial awareness scale is 0.984, Cronbach’s Alpha coefficient for the financial policy scale is 0.906, Cronbach’s Alpha coefficients for other parts are all greater than 0.8. This indicates that the reliability of the scales in this questionnaire are high, and subsequent research can be conducted. The variable names and definitions are indicated in Table 1, the means and standard errors of the national, eastern, central, and western samples are shown in Table 2, and the variable descriptive statistics of the entrepreneur samples are shown in Table 3.

As indicated in Table 2, samples from the east, central, and west account for 32, 32, and 38%, respectively. The sample distribution is relatively uniform. The samples from the pilot county account for 29%, and the samples of entrepreneurs account for 28%. By comparing the means of the national samples and the entrepreneur samples, it can be seen that the age of entrepreneurs is 2.28 years older than the average age of the national samples. Other variables representing the demographic characteristics of the participants, such as CPC member, cadre, education, health, years of working, work location, and job position, have no significant differences between the entrepreneur samples and the national samples. However, the proportion of entrepreneurs from the pilot counties is 6.4 percentage points higher than that of the national samples, which indicates that the entrepreneurship policies may have some positive effect on BHMWE. However, whether this effect is significant, and the magnitude of the effect are questions that require further exploration. It can also be seen in Table 3 that the average maturity of the sample enterprises is 3.722 years, the average sales revenue in 2020 is RMB 629,670, the average profit before tax is RMB 235,410, and the average number of employees is 9.793. This indicates that the sample enterprises examined are relatively new, have low sales revenue, low pre-tax profit, and small enterprise scale, and that these sample enterprises meet the requirements of the research objectives, namely, the sample enterprises should have been formed within the preceding 42 months. Table 3 also shows that 56% of the startups have used fiscal policy, 45.3% of them have used financial policy, 26.5% of them have used the land policy, 19.6% of them have used infrastructure policy, 27.8% of them have used talent policy, and 39.1% of them have used green channel policy. Overall, 72.5% of new businesses have used at least one of the entrepreneurship policies. The research problem then is to determine the extent to which these policies have increased the nascent firms’ employment, sales revenue, and pre-tax profits.

Results

Estimation of ATT on entrepreneurial entry

Propensity score matching (PSM) is not conditional on observable variables but on the probability of policy participation. The first step of PSM is to regress the treatment variable on a set of theoretically relevant covariates to estimate the probability of individual policy participation, that is, the propensity score. This study employed the logit method to determine the probability values for the national, eastern, central, and western samples, respectively. The treatment variable was the awareness of entrepreneurship policy (Policy 1), the covariates of the national sample were gender, age, marital status, ethnicity, education, CPC member, cadre, health, dependents, contract nature, years of working, work location, monthly income, job position, social security, entrepreneurship pilot county and region, (eastern or central China), a total of 18 variables; The covariates in each the samples from each region are the same as the national sample except for the two dummy variables of “east” and “central”, a total of 16 variables. The results for estimating the propensity score are presented in Table 4. In all four estimation equations, the LR chi2 and pseudo-R2 are greater than the critical values, and the joint F-test is highly significant. In the estimation of the national sample, 14 of the variables significantly affect the sample’s awareness of entrepreneurship policy, the four exceptions being the variables of “dependent”, “health”, “monthly income”, and “contract nature”.

Among the covariates, gender (male), age, marital status, CPC member, pilot county, cadre, educational level, and job position (technical or managerial) when employed all have a significant positive impact on the sample’s awareness of policy, which is consistent with entrepreneurship theory as is as expected. Ethnicity, region (east or central), years of working, work location, and social security negatively affect the sample’s awareness of entrepreneurship policy. The negative impact of awareness of policy by respondents from the central and eastern regions may be explained by the more urgent need for entrepreneurial activity in the western regions; thus, greater efforts have been made to promote entrepreneurship policies there. The possible reason that years of working and work location negatively affect the awareness of policy is that working for extended periods in provincial cities or municipalities may somewhat lower the samples’ interest in returning to start a business and to proactively learn about the entrepreneurship policies. When designing the social security variable, the value of “no social security purchased” was set as 1. Therefore, the negative impact of social security on the awareness of policy means that having social security can increase the willingness to go back and start a business and learn about the entrepreneurship policies, which is also to be expected. The variable of ethnicity will negatively affect the awareness of entrepreneurship policies. No explanation for this is obvious, but this result may be a pseudo-regression because the influence of ethnic Han in the eastern and central samples is not significant. In the eastern sample, seven variables of gender, age, ethnicity, health, years of working, monthly income, and contract nature have no significant impact. Number of dependents negatively impacts the sample’s awareness of entrepreneurship policy, and the direction of the impact of other variables on the awareness of policy is entirely consistent with the corresponding variables in the national sample. In the central sample, eight variables of ethnicity, CPC member, dependents, health, years of working, monthly income, contract nature, and job position have no significant impact, while the work location positively impacts the sample’s awareness of entrepreneurship policy. The impact direction of other variables on the awareness of entrepreneurship policy is entirely consistent with the corresponding variables in the national sample. In the western sample, seven variables of gender, CPC member, cadre, health, monthly income, contract nature, and job position have no significant impact, and the impact direction of other variables on the awareness of entrepreneurship policy is entirely consistent with the corresponding variables in the national sample. To be clear, although health, monthly income, and contract nature are not significant in any of the four logit models, empirically, these three variables are all correlated with entrepreneurial behaviour. In order to better meet the CIA conditions, we still retain these three variables in the matching process.

To ensure robustness, both nearest neighbour matching and kernel matching were used for estimation, and bootstrap methods were applied to calculate accurate estimation bias and significance statistics. Finally, the ATT of the entrepreneurship policy was determined by comparing the Ps R2, LR chi2, and the MeanBias of the estimation between the two matching methods. Table 5 presents the results of the two matching methods for the national and regional samples. All estimates pass the test at the 1% significance level. In the national sample, the policy participants’ probability of starting a business is 16.57–16.77% higher than if they did not participate. In the eastern sample, the policy participants’ probability of starting a business is 16.08–15.82% higher than if they did not participate, and in the central sample, the policy participants’ probability of starting a business is 16.73–17.42% higher than if they did not participate. In the western sample, the policy participants’ probability of starting a business is 17.21–16.33% higher than if they did not participate. Although there are differences between the two matching results, there is a strong consistency in the ATT estimates.

Since PSM is conditional not on all covariates but only on the propensity score, it is necessary to test whether the matching procedure can balance the distribution of covariates between policy participants and non-participants, to ensure that the variables used by the model do not differ significantly after matching. The balance testFootnote 4 results of the two matching methods for the four types of samples show that the standardized bias of covariates between the two groups was larger before matching, but most became less than 10% after matching. It can be seen from the comparison of the results before and after the matching that the standardized bias of all covariates was significantly reduced. The P-values also show that most of the characteristic variables of policy participants and non-participants are significantly different before matching. In contrast, the differences of all other variables except for one are no longer significant at the 10% level after matching. This indicates that the characteristic differences between the policy participants and the non-participants are effectively eliminated after matching. The quality indicators of the matching are presented in Table 6. The Ps R2, LR chi2, and MeanBias of the matching for the four samples all became smaller after matching, and the joint F-test of kernel matching in the national sample, the joint F-test of both nearest neighbour matching and kernel matching in the western sample are significant before matching, but not after matching. The significance of the joint F-tests in other matching decreased after matching. This indicates that the matching procedure used can balance the distribution of covariates between the treated and control groups, indicating a fair match.

The values of MeanBias, Ps R2, and LR chi2 of the kernel matching are smaller in the national, eastern, and western samples. A small MeanBias indicates a slight difference in each of the characteristics between participants and non-participants, and a small value of Ps R2 with insignificant joint F-test (the significance of joint F-test for kernel matching in the eastern sample decreased), together indicate that the systematic difference in the distribution of matched covariates between the two groups is becoming smaller. The insignificant F-test, or decrease of the significance, indicates that the covariates have no predictive ability for the participation variables or that the predictive ability has declined, thus better matching quality. Therefore, the results of kernel matching in the national, eastern, and western samples are closer to the actual value of the policy participation effect, that is, the ATT of the entrepreneurship policy in the national, eastern, and western samples is 16.77, 15.82, and 16.33% respectively. By comparing the quality indicators of the two matching in the central sample, it becomes apparent that the quality of the nearest neighbour matching is better, so the policy participation effect in the central sample is 16.72%. This indicates that the marginal effect of the entrepreneurship policy in the central and western regions is higher than it is in the eastern region.

Given that the data of the east, central, and west are from Zhejiang, Henan, and Guizhou, respectively, it appears that the marginal effect of entrepreneurship policy in Henan and Guizhou is greater than that in Zhejiang. This can likely be explained by the greater number of startups in Zhejiang and the Law of Diminishing Marginal Effect of entrepreneurship policy. If the possibility that different entrepreneurial policy instruments function in different entrepreneurial stages is taken into account, it seems likely that these policy effects result from training, industrial, organizational, and other policy instruments that target the entrepreneurial preparation stage.

Estimation of ATT on employment, industrial development, and poverty alleviation

In order to examine the average treatment effect of entrepreneurship policies on employment, industrial development, and poverty alleviation, the ATTs of participating in the overall entrepreneurship policy and the specific policies in the six areas of fiscal, financial, land, infrastructure, talent, and green channel policies are estimated. The explained variables include Ln (employees), Ln (sales revenue), and Ln (profit before tax), while the explanatory variables involve gender, age, marital status, nationality, CPC member, east, central, pilot county, district, number of dependents, education, health condition, years of working, work location, job position, years since founding, self-funded when founded and the amount of financing, all of which have been considered as possibly influencing either the explanatory variables and/or the participation variables. Just as what has been done in section 5.2, nearest neighbour and kernel matching were used to simultaneously derive the estimation, while the bootstrap method was used to calculate the estimated standard error and significance level to ensure robustness. Table 7 shows the quality indicators for estimating the employment effect, industrial development effect, and poverty alleviation effect of the overall policy as well as the six specific policiesFootnote 5. It can be seen from the table that the Ps, R2, LR chi (2), and MeanBias of all models become smaller after matching, and the joint F-test is significant before, but not after matching, indicating fair matches.

Tables 8, 9, and 10 list the kernel matching results for the ATTs of overall as well as the six specific entrepreneurship policies on employment, industrial development, and poverty alleviation. Table 8 shows that although the overall entrepreneurship policy, financial policy, and green channel policy do not have a significant impact on the number of employees, the other four types of policies have a highly positive impact on the number of employees. The number of people employed by enterprises using fiscal policy is 22.56% higher than if they were not; the number of people employed by enterprises using land policy is 37.805% higher than if they were not, and the number of people employed by enterprises using infrastructure policy is 40.471% higher than if they were not. The number of people employed by enterprises with the talent policy is 14.832% higher than if they were not. From the magnitude of ATTs, the entrepreneurship policies with a greater effect on employment are, in descending order, infrastructure policy (in this study, infrastructure policy refers to “Priority to or preferential access to the business park or incubation base”), land policy, financial policy and talent policy (in this study, talent policy refers to “participating in skills training conducted by local government, access to training subsidies, and the local talent introduction policy.”). The effect of the overall entrepreneurship policy on the number of employees is not significant, indicating that the overall employment-driving effect of entrepreneurship policy is not apparent, which may be related to the short time since the firms’ founding, and the small scale of the enterprises. It can be seen from the mean value in Table 3 that the average time since the founding of the sample enterprises is only 3.722 years, including some founded within a few months prior, but counted as one year. The average number of employees is only 9.793.

Table 9 shows that financial policy and land policy have no significant impact on sales revenue, while other policies do have a significant positive impact on the sales revenue of the participants. The sales revenue of enterprises using the overall entrepreneurship policy is 25.08% higher than if they were not, indicating that the overall entrepreneurship policy has an effect on industrial development on the whole. The sales revenue of enterprises using fiscal policy is 17.863% higher than if they were not, and the sales revenue of enterprises using the infrastructure policy is 39.55% higher than if they were not; The sales revenue of enterprises using the talent policy is 26.728% higher than if they were not; The sales revenue of the enterprises using the green channel policy is 22.467% higher than if they were not. From the magnitude of the ATTs, the entrepreneurship policies with the greater effect on industrial development are, in descending order, infrastructure policy, talent policy, green channel policy, and financial policy.

Table 10 shows that, except for financial policy, all policies have a significant impact on participants’ profit before tax. Profit before tax for enterprises using the overall entrepreneurship policy is 36.191% higher than if they were not, indicating that the overall entrepreneurship policy has an effect on poverty alleviation. The profit before tax for enterprises using the fiscal policy is 27.259% higher than if they were not; the profit before tax for enterprises using the land policy is 28.049% higher than if they were not; the profit before tax of enterprises using the infrastructure policy is 38.952% higher than if they were not; the profit before tax of the enterprises using the talent policy is 21.667% higher than if they were not, and the profit before tax of the enterprises using the green channel policy is 25.791% higher than if they were not. From the magnitude of the ATTs, the entrepreneurship policies with the greater effect on profit before tax are, in descending order, infrastructure policy, land policy, fiscal policy, green channel policy, and talent policy.

By comparing the ATTs of the overall and the six specific entrepreneurship policies in Tables 8, 9, and 10, it can also be seen that the overall policy’s employment effect is not significant, but its industrial development effect and poverty alleviation effect are highly significant, and that the poverty alleviation effect is 36.191–25.080 = 11.111 percentage points higher than the industrial development effect. The employment effect of the green channel policy is not significant; the sales revenue effect of the land policy is not significant. The impact of financial policy on the number of employees is not significant, nor is the effect of the sales revenue or the profit before tax significant. These results indicate that the financial policy does not work as hoped by boosting employment, industrial development, poverty alleviation, or increasing income. Considering the well-established importance of venture financing in the entrepreneurship process, the insignificant effect of financial policy on the three aspects above likely results from a combination of factors, including the lack of financial products tailored for rural entrepreneurs, the lack of access to venture capital and the overall lack of available financial products. The remaining specific policies have played their expected role in boosting employment, industrial development, poverty alleviation, and increasing income, among which the smallest ATT is the employment effect of talent policy (14.832%), and the largest is the employment effect of infrastructure policy (40.471%). The effect of infrastructure policy on boosting employment, industrial development, and poverty alleviation is the largest among the three effects of the other specific entrepreneurship policies, which provides compelling evidence to encourage the construction of incubator parks and business incubation support.

Conclusions, contributions, discussion and limitations

Conclusions

The research objects are the series of BHMWE policies enacted by China’s National People’s Congress, the State Council, and relevant Ministries and Commissions of the State Council of China since 2015. The goal is to examine the effectiveness of BHMWE policies. The sampling population covers the three provinces of Zhejiang, Henan, and Guizhou, which are spread across China’s eastern, middle and western regions. The policy variables examined are the overall policy, fiscal policy, financial policy, land policy, infrastructure policy, talent policy, and green channel policy. The dependent variables are the outcomes of those policies, including the probability of entrepreneurial entry, Ln (number of employees), Ln (sales revenue), and Ln (profit before tax) of the nascent firms. The methodology employed is Propensity Score Matching (PSM).

This study presents multiple findings. (a)The awareness of entrepreneurial policies significantly affects the probability of entrepreneurial entry of the BHMWs. The average treatment effect on the treated (ATT) of policy participation in the national, eastern, central, and western samples, namely, the probability of entrepreneurial entry of the BHMWs knowing and/or using at least one of the entrepreneurship policies is 16.77, 15.82, 16.72, and 16.33% higher than if they were not. (b)Fiscal, land, infrastructure, and talent policies significantly affect the number of employees of the nascent firms. The ATT of the four policies is 22.56, 37.81, 40.47, and 14.83%, respectively, while the overall entrepreneurship policy, financial policy, and green channel policy have no significant influence on the number of employees. (c)The overall, fiscal, infrastructure, talent, and green channel policies significantly affect the sales revenue of the nascent firms. The ATT of the five types of policy is 25.08, 17.86, 39.55, 26.73, and 22.46%, respectively. The impact of financial policy and land policy on sales revenue is not significant. (d)Overall, fiscal, land, infrastructure, talent, and green channel policies significantly affect the profit before tax of the nascent firms. The ATT of the six kinds of policy is 36.19, 27.26, 28.05, 38.95, 21.67, and 25.79%, respectively. The influence of financial policy on the profit before tax is not significant (e). From the perspective of entrepreneurship policies as a whole, the poverty alleviation effect is greater than the industrial development effect, but the employment effect is not significant (f). From the perspective of various specific policies, the employment, industrial development, and poverty alleviation effects of infrastructure policy are greater than those of other policies, while the employment, industrial development, and poverty alleviation effects of financial policy are not significant.

Contributions

The major contribution of this study is to test the net effect of entrepreneurship policy on “new venture creation”, which fills the gap in the existing literature on the core indicator of the policy effect of entrepreneurship entry. The most straightforward way to test entrepreneurship policy’s effectiveness is to answer the question: To what extent do entrepreneurship policies affect the probability of starting a new business? Policymakers specifically will find these results of interest in supporting the development of future entrepreneurship-related policies because this has not been well addressed in the existing literature. Secondly, the data used in this study has the advantage of large sample size and multiple covariates. This combination makes it possible for the application of strict matching procedures to test policy effect indicators such as employment, sales revenue, and pretax profit, and make reasonable responses to the inconsistencies in these three indicators in current literature. Nineteen covariates (18 for the entrepreneur sample) were added, including individual characteristics, job characteristics, and sample regional characteristics into the national, eastern, central, and western samples, so as to meet the requirements of the CIA condition as nearly as possible. In all of the matching processes, there are enough control group samples to match with the treatment group samples, which meets the common support conditions. The balance test indicates that after matching, the mean value difference between the treatment and control groups falls almost entirely within a 10% range. The mean bias and significance level were estimated by bootstrap, thus ensuring the quality of matching. Nearest neighbour and kernel matching were used simultaneously to test the robustness of the results, ensuring good internal validity.

The application contribution of this study is driven by the breadth and thorough empirical testing of the effectiveness of the BHMWE policies, which provides China’s government with directly applicable and robust empirical evidence on the continuous input of the overall entrepreneurship policy and the adjustment of individual policies. The findings are generalizations and thus provide other developing economies with systematic direction for the design and adjustment of entrepreneurship policy at national level. Unlike the existing literature on this topic that only examines a single entrepreneurship policy, this study examines a complete entrepreneurship policy system. Policy variables include not only policies such as fiscal subsidies and financial support but also non-financial policies such as entrepreneurship training and policy consultation, as well as comprehensive policies with entrepreneurship incubation as the main content. This study makes the unique contribution of estimating the effects of the complete and overall national entrepreneurship policy.

Discussion and implications

Before discussing the policy implications of the above findings, it is necessary to clarify the difference between entrepreneurship policy and SME policy. Although some researchers generally combine the two, others, including Storey (2003), make clear the critical and substantial difference between the two. SME policies focus on existing enterprises and aim to help those SMEs become more competitive. In contrast, entrepreneurship policies focus on potential entrepreneurs and the owners and operators of new ventures and startups, where the policy goal is to help start a new business and provide the support necessary to ensure it survives. Therefore, according to the Global Entrepreneurship Monitor (GEM) criteria, entrepreneurship policy objectives should focus on businesses founded within 42 months. The average age of the companies in the sample used in this study was 3.7 years (about 44 months), which is aligned with the GEM criteria for nascent firms. However, precisely because of the short establishment time and small scale of enterprises, the non-significant employment effect of the overall entrepreneurship policy does not necessarily mean that the entrepreneurship policy has failed, and it is very likely the result of the combined effect of the recency of founding, and the non-significant employment effect of both financial and the green channel policies. The long-term employment effect of the overall entrepreneurship policy is an area that calls for further exploration. Among the individual policies, infrastructure policy was found to play the most critical role, a finding that serves to affirm the value of business incubation. The effect of financial policy on increasing employment, industrial development, and poverty alleviation are not significant. The consistency in the effect of financial policy on those three fields may imply a failure in the design of the financial policy instrument to support BHMWE. Although frequently used by local governments, fiscal policy is not the most impactful policy instrument in terms of policy effectiveness.

Therefore, this study affirms the positive effectiveness of the BHMWE policies implemented by the central government of China since 2015. The findings also indicate that: (a) SME policies need to be continuously reinforced to maximize the role of entrepreneurial enterprises in driving employment. (b) Policy input to the central and western regions should be increased not only because of the poor basic conditions for encouraging entrepreneurship in the central and western provinces but more importantly because the marginal effect of entrepreneurship policies is larger. (c) The financial policy for the BHMWs may need to be redesigned.

Limitations

While this study provides well-supported conclusions, contributions, and clear implications, as with all studies, there are limitations. (a) Due to funding limitations and travel restrictions brought about by the pandemic, data collection was limited to the three provinces of Zhejiang, Henan, and Guizhou. While these three represent a breadth of socio-economic and policy conditions, the findings would be strengthened by the inclusion of sample data from a greater geographic area. (b)There are differences in the specific policy effects among different provinces and between pilot counties and non-pilot counties, obviously, the heterogeneity needs to be further tested (c).The field investigation reveals that the organizing and coordinating work done by the members of the local government is an indispensable policy instrument. The survey instrument was not designed to capture the quantifiable data on this variable, thus further exploration is warranted.

Data availability

The datasets generated and/or analysed during the current study are available from the corresponding authors on reasonable request.

Notes

In China, the term migrant workers refer to the labor force group who are born, mostly brought up, and own land and real estate in rural areas, but are engaged in non-agricultural production in urban areas all year round and usually have to make seasonal, long distance round trips between their working and residential locations. Back-home migrant workers’ entrepreneurship (BHMWE) refers to the entrepreneurial behavior of migrant workers within the county where they are registered.

According to the 2021 Migrant Workers Monitoring Survey report of the National Bureau of Statistics of China, the total number of migrant workers in China in 2021 was 292.51 million. https://www.stats.gov.cn/xxgk/sjfb/zxfb2020/202204/t20220429_1830139.html.

Hukou is the system used in China for establishing residency in a district, city, or town. Citizens are registered in the Hukou where they reside and may access civic and social benefits based on their residency. Hukou may be considered rural/agricultural or urban/residential.

This study involves two matching methods of one national sample, and three regional samples with a total of 8 balance tests. Due to space limitations, the 8 tables of the balance test are not presented here.

The quality indicators for estimating the three effects of the overall policy and the six specific policies are exactly the same.

References

Amezcua AS (2010) Boon or boondoggle? Business incubation as entrepreneurship policy: A Report from the National Census of Business Incubators and their Tenants. Dissertation, Unpublished manuscript from post-doc scholar at Syracuse University

Autio E, Rannikko H (2016) Retaining winners: Can policy boost high-growth entrepreneurship? Res Policy 45(1):42–55. https://doi.org/10.1016/j.respol.2015.06.002

Caliendo M, Künn S (2011) Startup subsidies for the unemployed: Long-term evidence and effect heterogeneity. J. Public Econ. 95(3–4):311–31. https://doi.org/10.1016/j.jpubeco.2010.11.003

Criscuolo C, Martin R, Overman HG, Van Reenen J (2019) Some causal effects of an industrial policy. Am. Econ. Rev. 109(1):48–85. https://doi.org/10.1257/aer.20160034

Dewi Y, Hanifah HT (2022) Start-up performance: mapping pillars of global entrepreneurship index and the development of studies. International Journal of Human and Technology Interaction (IJHaTI), 6(1). https://www.researchgate.net/publication/366877290

Fairlie RW, Karlan D, Zinman J (2015) Behind the GATE Experiment: Evidence on effects of and rationales for subsidized entrepreneurship training. Am. Econ. J.-Econ. Polic. 7(2):125–61. https://doi.org/10.1257/pol.20120337

Fang M (2021) Entrepreneurship training, policy acquisition and entrepreneurial performance of returned migrant workers. J. Beijing Technol. Bus. Univ. 36(6):116–26. https://doi.org/10.12085/j.issn.1009-6116.2021.06.011

Figueroa-Armijos M, Johnson TG (2016) Entrepreneurship policy and economic growth: Solution or delusion? Evidence from a state initiative. Small Bus. Econ. 47(4):1033–47. https://doi.org/10.1007/s11187-016-9750-9

Goetz SJ, Partridge MD, Deller SC, Fleming DA (2010) Evaluating US rural entrepreneurship policy. J. Reg. Anal. Policy 40:1100-2016-89676. https://doi.org/10.22004/ag.econ.132438

Mirzanti IR, Simatupang TM, Larso D (2018) Evaluation of emerging entrepreneurship policy. Int. J. Econ. Policy Emerg. Econ. 11(1-2):49–67. https://doi.org/10.1504/IJEPEE.2018.091034

Mole K, Hart M, Roper S, Saal D (2008) Differential gains from business link support and advice: A treatment effects approach. Environ. Plan C.-Polit. 26(2):315–34. https://doi.org/10.1068/c0711

Rigby J, Ramlogan R (2016) The impact and effectiveness of entrepreneurship policy. In: Edler J, Cunningham P, Gök A (ed) Handbook of innovation policy impact. Edward Elgar Publishing, Cheltenham, p 129–160

Roper S, M Hart (2005) Small Firm Growth and Public Policy in the UK: What Exactly Are the Connections? Dissertation, Aston University Business School

Rotger GP, Gørtz M, Storey DJ (2012) Assessing the effectiveness of guided preparation for new venture creation and performance: Theory and practice. J. Bus. Ventur. 27(4):506–21. https://doi.org/10.1016/j.jbusvent.2012.01.003

Schwartz M (2013) A control group study of incubators’ impact to promote firm survival. J. Technol. Transf. 38(3):302–31. https://doi.org/10.1007/s10961-012-9254-y

Smallbone D (2020) Entrepreneurship policy: Issues and challenges. In: Smallbone D (ed) Understanding the Development of Small Business Policy, 1st edn. Routledge, London, p 6–23

Storey DJ (2003) Entrepreneurship, small and medium sized enterprises and public policies. In: Acs ZJ, Audretsch DB (ed) Handbook of entrepreneurship research: An interdisciplinary survey and introduction. Springer, New York, p 165–182

Wren C, Storey DJ (2002) Evaluating the effect of soft business support upon small firm performance. Oxf. Econ. Pap. 54(2):334–65. http://www.jstor.org/stable/3488783

Wu YL, Huang Z (2018) An empirical study on entrepreneurship policy based on PSM: A case of fiscal and tax policy evaluation. Macroeconomics 09:123–75. https://doi.org/10.16304/j.cnki.11-3952/f.2018.09.01

Acknowledgements

The work was supported by the National Social Science Fund of China (Grant number: 20BRK014).

Author information

Authors and Affiliations

Contributions

XZZ and RKM: conceptualization, methodology, data collection, formal analysis, writing-original draft, writing review & editing, project administration. CYP: investigation, data curation, writing review & editing, software and visualization.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

The questionnaire and methodology for this study were approved by the Ethics Committee of Guangzhou Institute of Science and Technology (Reference number: GZIST2023006). The procedures used in this study adhere to the tenets of the Declaration of Helsinki.

Informed consent

Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements. There was an online informed consent for participation, who were informed that: (a) the collected data were contributed to academic research rather than any commercial activities; (b) the personal information would not be published. If the participants wished to consent to the instruction, they clicked “agree and continue” button. They were then able to fill-in the questionnaires.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhao, X., Marjerison, R.K. & Peng, C. The impact and effectiveness of China’s entrepreneurship policy for back-home migrant workers. Humanit Soc Sci Commun 11, 623 (2024). https://doi.org/10.1057/s41599-024-03130-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03130-1